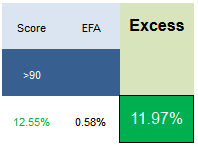

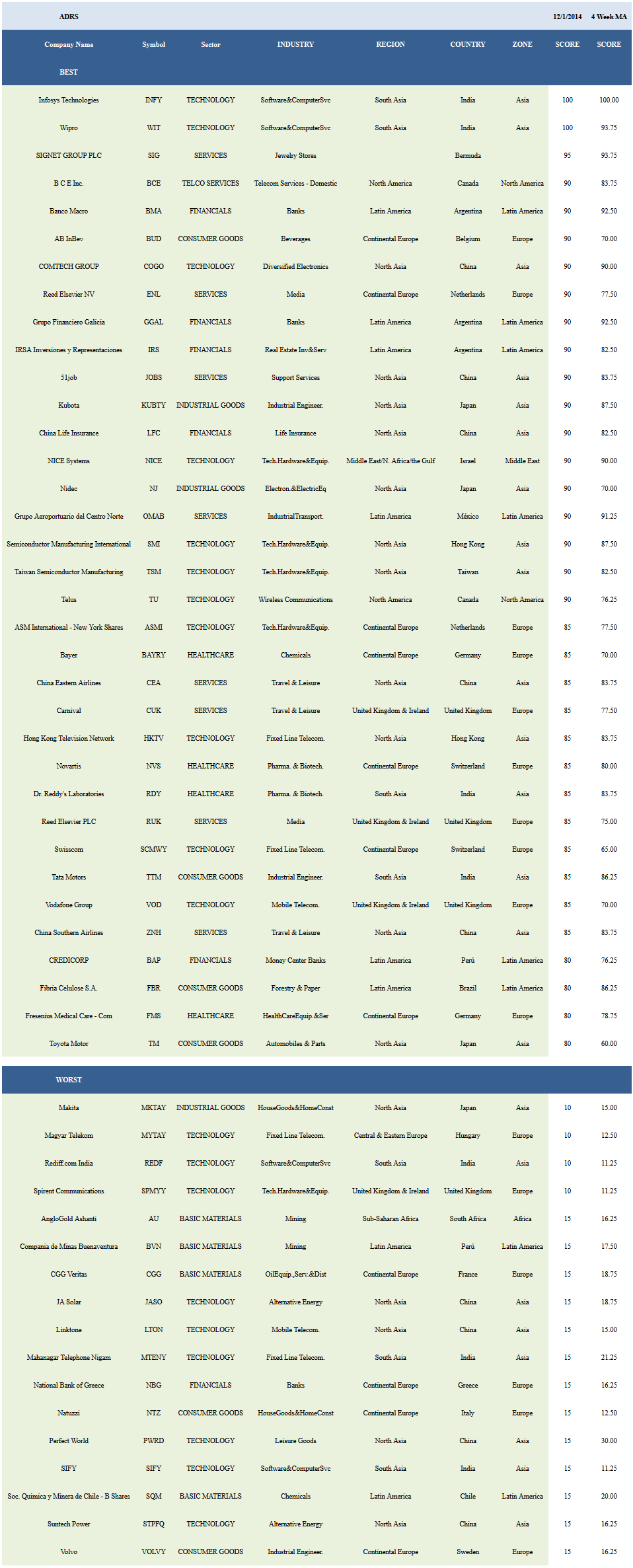

The average return of our best scoring ADRs from 1-year ago (12/2/2013) returned 12.55% in the past year, with no turnover. That generated 1,197 bps of excess to the MSCI EAFE index. The best performers from our list last year include SIG up 72%, SHPG up 62%, IRS up 49%, RDY up 47%, and TTM up 42%.

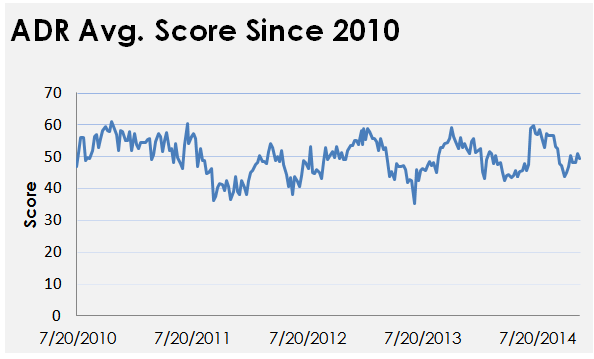

The average score is 49.36, above the four week moving average score of 49.15. The average ADR is trading -22.4% below its 52 week high, -5.24% below its 200 dma, has 3.63 days to cover held short, and is expected to post EPS growth of 18.54% next year.

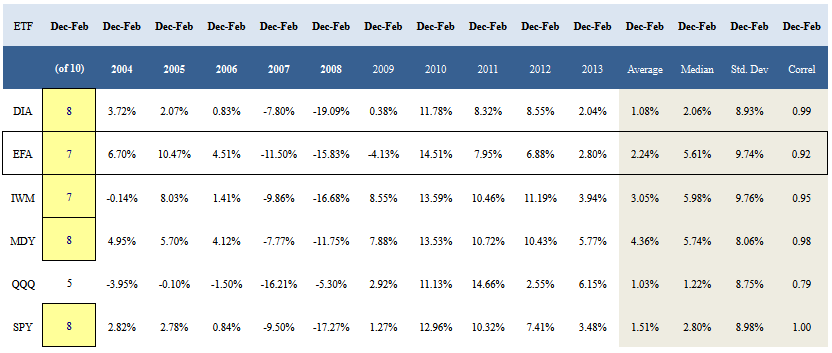

The following table shows major market ETF seasonality for the 3-month period ending Feb. 28th. Over the past decade, the MSCI EAFE (EFA) has gained ground seven times, generating a median return of 5.61%.

Click on picture to enlarge

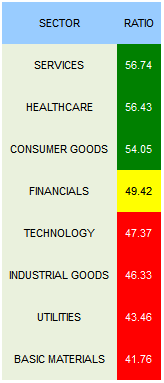

The top scoring sector across ADRs is services (SIG, ENL, OMAB, jobs, RUK, CUK, ZNH, CEA, RYAAY, ICLR, DEG). Healthcare (NVS, RDY, BAYRY, FMS, LUX, RHHBY, TEVA, NVO) and consumer goods (BUD, TTM, TM, FBR, BTI, NSRGY, NSANY, SORL, CRESY) also score above average. Financials score in line. technology, industrial goods, utilities, and basic materials score below average.

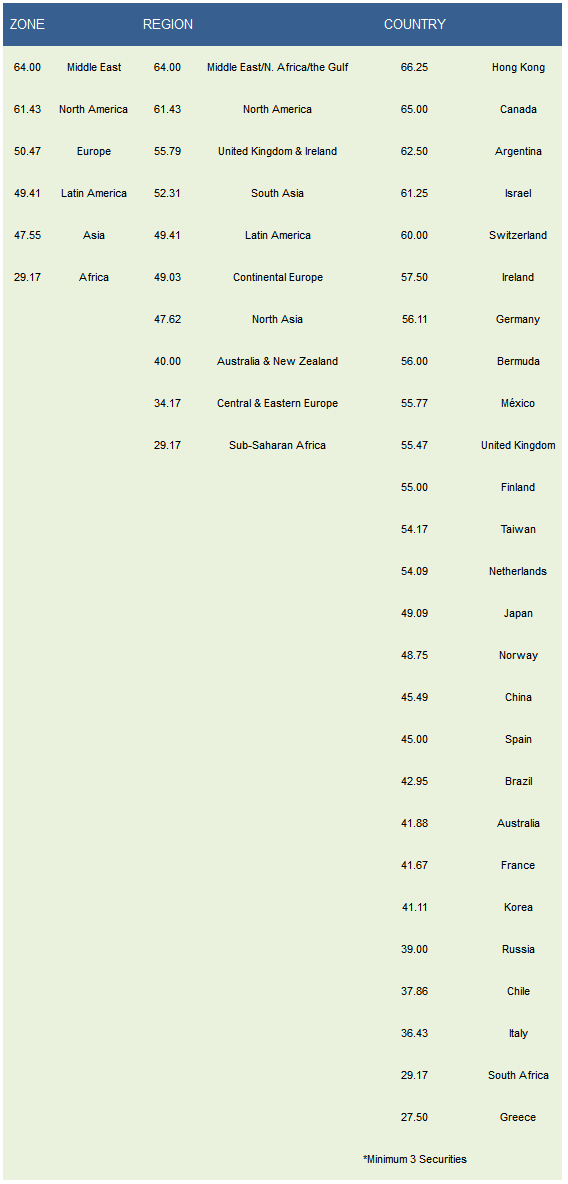

The top scoring zone is the Middle East (NICE, TKC, TEVA), followed by North America (TU, BCE, RY, BMO). MENA, North America, and the U.K./Ireland (VOD, RUK, CUK, RYAAY, ICLR, ARMH) are the best regions. The best countries are Hong Kong (SMI, HKTV, MPEL), Canada (TU, BCE, RY, BMO), Argentina (IRS, GGAL, BMA, BFR, TEO, CRESY), Israel (NICE, TEVA), and Switzerland (SCMWY, NVS, RHHBY, NSRGY, LOGI).