High dividend Master Limited Partnerships (MLP) have been decimated as measured by the Alerian MLP index which is down roughly 50% since August 2014. Once the darlings of income-seeking investors, fear has set in as many investors sold out of their positions believing low energy prices would create a vicious circle whereby MLPs would be unable to obtain new capital and their healthy growing dividends would inevitably be cut. However, not all MLPs are created equal, and the market turmoil has created some impressive opportunities. In particular, we believe Enterprise Products Partners' (EPD) big 6.4% dividend yield is very safe, it will continue to grow, and buying now offers investors an opportunity for big price appreciation to boot.

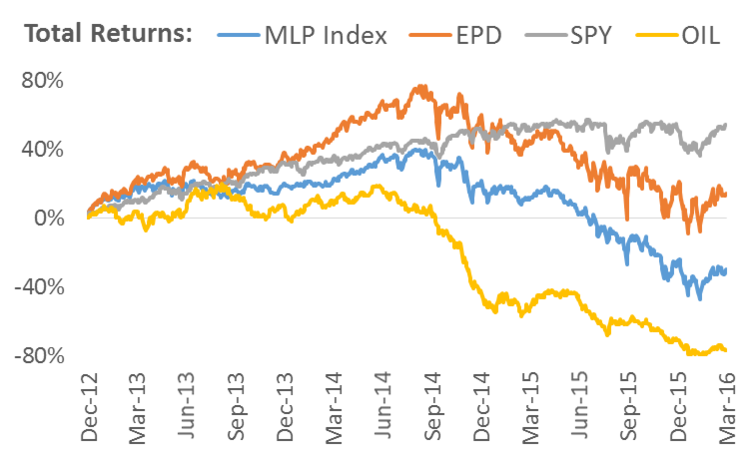

For perspective, the following chart shows the recent performance of the MLP index compared to the overall market (i.e. the S&P 500), and we've also included the performance of Enterprise Products and oil.

As the chart shows, the market started to stall as oil prices began to fall in mid-2014, and MLPs (including EPD) fell precipitously right along with oil. In our view, EPD should not have sold off with other MLP's because of its uniqueness and financial strength. But before getting into the details of EPD, it's worth briefly considering what exactly a Master Limited Partnership is and why they sold off so dramatically.

What is an MLP, and why have they sold off?

A Master Limited Partnership is an organizational structure that qualifies for significant tax benefits. Specifically, MLPs are not taxed at the entity level (this is different from typical corporations) as long as they generate 90% of their income from “qualifying” sources such as the production, processing and transportation of oil, natural gas and coal. Additionally, if you own an MLP you may be able to deduct some of the MLPs depreciation expense on your own income tax return (you'll receive a K-1 tax form at the end of the year to help you track this). Historically, both of these tax benefits have made it much easier for MLPs to attract cheap capital and to grow their big dividends.

However, the recent decline in energy prices has increased uncertainty (and increased capital costs) for many MLPs. Specifically, higher capital costs have made it very challenging for some MLPs to raise the capital necessary to grow their business and fund their precious dividends. And as fears of possible dividend cuts have increased, MLP prices have declined dramatically.

Why is EPD Different?

For many investors, all they need to know before investing in Enterprise Products is that is has a long history of paying (and increasing) its dividend. Specifically, “Enterprise has paid 70 quarterly cash distributions to unitholders since its initial public offering of common units in 1998… [And] on January 4, 2016, the partnership declared its 46th consecutive quarterly increase.” (2015 Letter to Shareholders). For perspective, the following chart shows the compound annual growth rate of EPD's dividends since its initial public offering: