Fresh comments from Cleveland Fed President Loretta Mester suggest the Federal Open Market Committee (FOMC) will continue to normalize monetary policy over the coming months as the 2018 voting-member sees ‘salient upside risks' to the economic outlook, and a growing number of central bank officials may prepare U.S. households and businesses for higher borrowing costs as Chair Janet Yellen and Co. forecast three rate-hikes for this year. With that said, the FOMC may utilize the January 31 interest rate decision to endorse a March rate-hike especially as ‘many participants judged that the proposed changes in business taxes if enacted, would likely provide a modest boost to capital spending.'

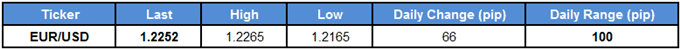

Nevertheless, the broader outlook for EUR/USD remains constructive as both the exchange rate and the Relative Strength Index (RSI) extend the upward trends from late last year, but the bullish momentum appears to be tapering off as the oscillator slips below 70 and flashes a textbook sell-signal.

EUR/USD Daily Chart

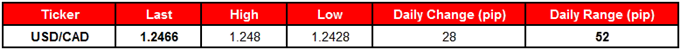

The reaction to the Bank of Canada's (BoC) first interest rate decision for 2018 limits the downside risk for USD/CAD as the central bank delivers a dovish rate-hike, with the topside targets coming back on the radar following the failed attempt to test the monthly-low (1.2355).