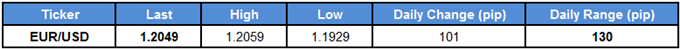

EUR/USD appears to be making another run at the September-high (1.2092) as the European Central Bank (ECB) strikes an upbeat tone and warns ‘the Governing Council's communication would need to evolve gradually.'

The account of the December monetary policy meeting suggests the ECB will stay on its current course to wind down the quantitative easing (QE) program by September 2018 as ‘the latest staff projections foresaw that the output gap would close in the near future, earlier than previously projected.'

Even though ‘members widely agreed that the Governing Council needed to remain patient and persistent with its monetary policy,' President Mario Draghi and Co. may continue to prepare European households and businesses for a less accommodative stance as officials note ‘that the Governing Council's communication should be adjusted gradually over time to avoid sudden and unwarranted movements in financial conditions.'

As a result, the ongoing shift in the monetary policy outlook should continue to prop up the single-currency, with EUR/USD at risk of extending the advance from the November-low (1.1554) as both price and the Relative Strength Index (RSI) extend the bullish formations carried over from late last year.

EUR/USD Daily Chart