The US dollar is making a comeback after the Trump Slump or Trump Dump. Fresh optimism about deregulation? Rising stocks? In any case, the US dollar is on the rise.

US jobless claims were expected to rise back to 247K but actually jumped to 259K, worse than expected. Will this hurt the momentum of the greenback? The indicator reached a low of 237K according to the revised figure and occasional swings are not uncommon. Later, the US releases its new home sales.

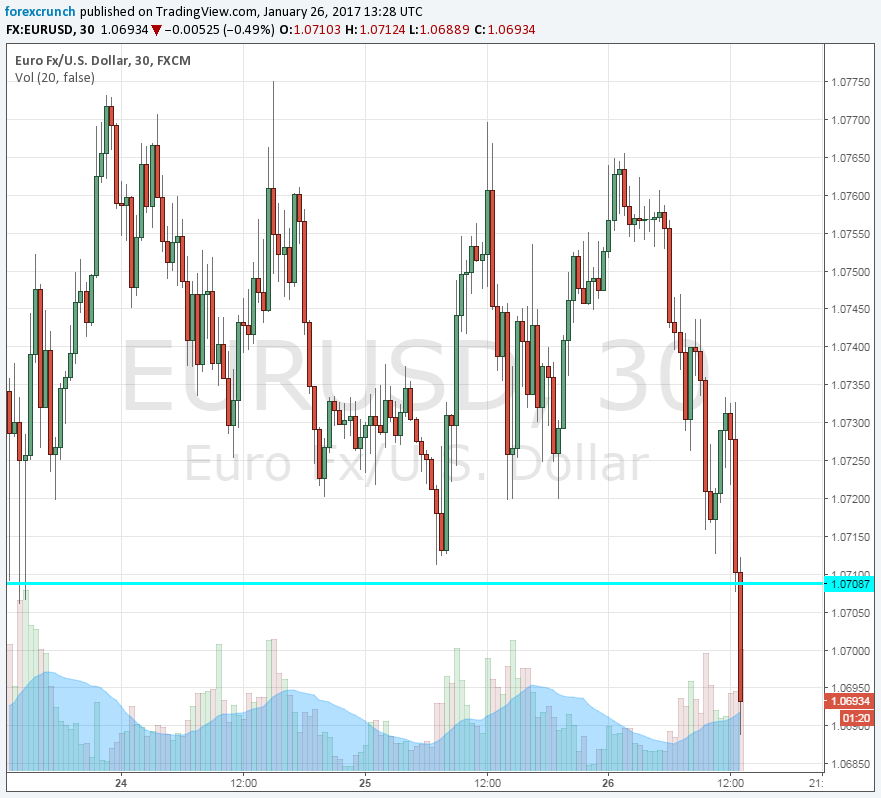

And EUR/USD, which has been relatively stable while other currencies moved in a more volatile manner, is feeling the heat.

The pair is sliding by over 50 pips under support at 1.0710 (an old line from 2016) and below the round level of 1.07. Further support awaits at 1.0650 and afterward it's only 1.0520.

Can the pair continue lower? Is euro/dollar parity still a viable option?

Tomorrow there is a key US publication: the first GDP report for Q4.