Previous:

On Friday the 20th of April, trading on the EUR/USD pair closed down. The single currency dropped against the dollar to 1.2293 during the European session, falling further to 1.2249 in the US. An increase in US bond yields gave way to rise for the US dollar. US10Y bond yields hit a high of 2.966%; its highest value since January 2014. This rise in bond yields occurred in anticipation of increased interest rates.

News agency Bloomberg added fuel to the fire after reporting that the ECB could delay making a decision on reversing the QE program until their meeting in July.

Day's news (GMT+3):

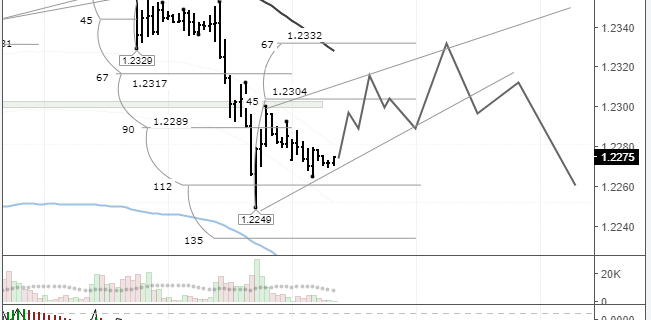

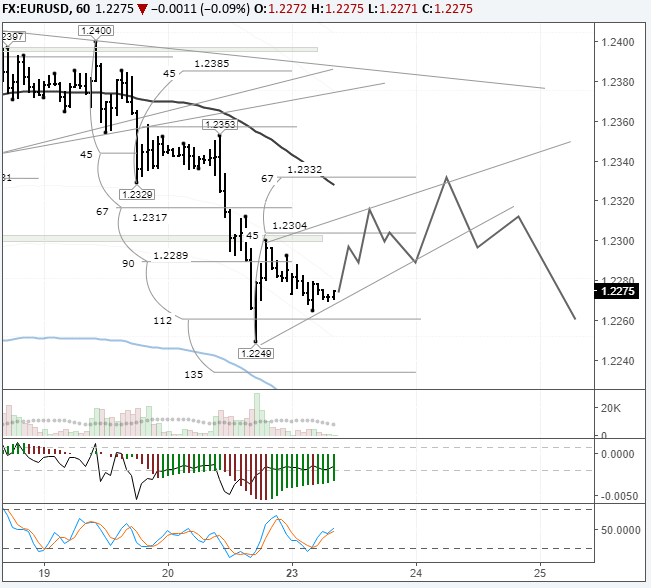

Fig 1. EUR/USD hourly chart. Source: TradingView

It was revealed over the weekend that North Korea plans to suspend its nuclear weapons program and will close its test site. Looking at how trading opened today as well as at risky assets, it seems this news hasn't been taken too seriously. The major currencies are showing mixed dynamics against the dollar in today's Asian session.

Thanks to some correctional movements on the crosses, the pound, loonie, and Aussie are all trading up. For now, I can't see an end to this downwards correction, but I do expect to see a correctional movement to 1.2332 in the next 23 hours. Since all of the major euro crosses are trading down, the bears will try to reach the local Asian minimum of 1.22263.

I think the upwards movement will happen in two phases; taking the shape of an ascending triangle. First, a recovery to the 45th degree, followed by a jump to the 67th. The LB balance line, which is currently sitting at 1.2329, provided some resistance at 1.2315.