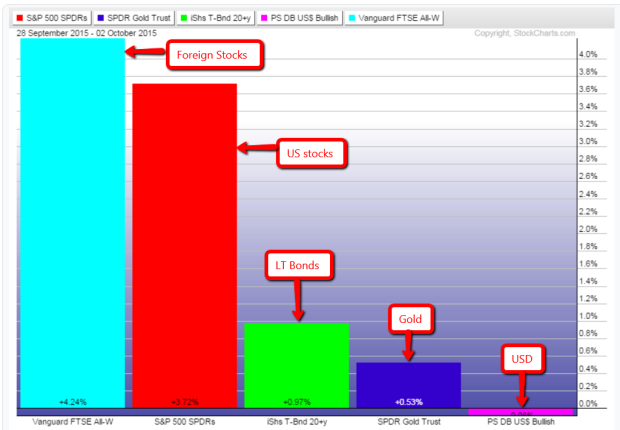

As we closed the book on the 3rd Quarter 2015, it was another volatile week in the financial markets. Equities outperformed on a weekly basis, with US stocks gaining 3.72% and Foreign stocks gaining 4.24%.

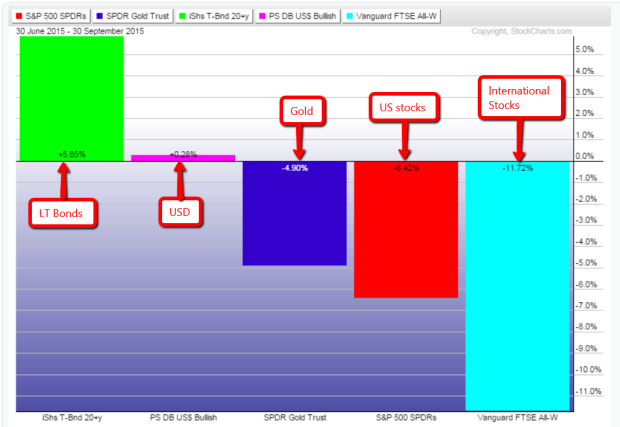

On a quarterly basis we see a different picture. Foreign stocks lost 11.72% and US stocks lost 6.42%. This marks the 3rd quarter 2015 performance as the worst quarter we have seen since the 3rd quarter of 2011, when the S+P 500 lost 13% in the quarter.

The one bright spot was in bonds, as the US long term treasury bonds index finished up 5.85% amidst all the carnage. There is a lot of negativity surrounding bonds as a whole. Worries range from lack of liquidity to higher rates hurting future expected returns. While each is a valid concern, the biggest concern an individual investor must assess is the goals of the portfolio. In other words you should know what you own and why you own it.

The biggest piece of economic data this week was the September NFP employment report. The street was expecting an addition of 201k jobs for the month but the actual number came in at 142k. On top of this the numbers for the prior two months were revised downward as well. Overall it wasn't a good report and the market immediately sold off because of it.

The Dow was down some 250 points at the lows on Friday. But then buyers stepped in and by the close the Dow ended up 200 points. There a few potential explanations:

It could be anyone of these factors or a combination. The fact is that Friday's upside reversal was quite a feat. But there is still a lot of technical damage that was done by August's sell off, as all major averages and AD line remain below their 50 and 200 day moving averages. And so we aren't out the woods yet.