More free money!!!

Europe is up 2% with no signs of slowing at lunch as Mario Draghi kicks it up a notch, saying the ECB is ready to “step up the pressure

” and expand its asset-purchase programs if inflation fails to show signs of quickly returning to the ECB's target. BAM!!!

“We will continue to meet our responsibility—we will do what we must to raise inflation and inflation expectations as fast as possible, as our price stability mandate requires of us. If on its current trajectory our policy is not effective enough to achieve this, or further risks to the inflation outlook materialize, we would step up the pressure and broaden even more the channels through which we intervene, by altering accordingly the size, pace and composition of our purchases,”

That was enough to send the Euro plunging 1% ($1.24) as the Dollar jumped over the 88 line for the first time since 2010, when the Global economy was collapsing and we looked like the only game in town. Well, China wasn't going to take that lying down so, of course, the PBOC, in the middle of the night on Friday in China, suddenly decided to cut their own rates by 0.4 to 5.6% and they lowered their deposit rate by 0.25, to 2.75% effective tomorrow.

“All the targeted easing measures or the mini stimulus measures to cut the cost of financing are in fact ineffective,” said Chang Jian, chief China economist at Barclays Plc in Hong Kong, who correctly forecast one interest rate cut in the fourth quarter of this year. “So the only way to really reduce the cost of financing is through cutting the benchmark rate.”

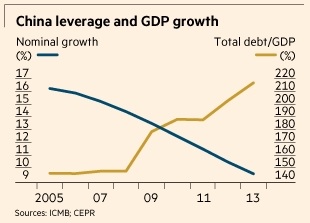

Today's move suggests a shift toward pro-growth policies that may fuel even more debt. An unprecedented lending spree from 2009 to 2013 led to a surge in debt on a scale that's triggered banking crises in other economies, according to the International Monetary Fund. China's total…