If a bond has a negative yield, then the bondholders will lose their money on their investment. In the long run, their expectations are lower and consequently they lose the incentive to invest — which may have far-reaching repercussions.

Green Bonds Are Changing Investor Expectation's

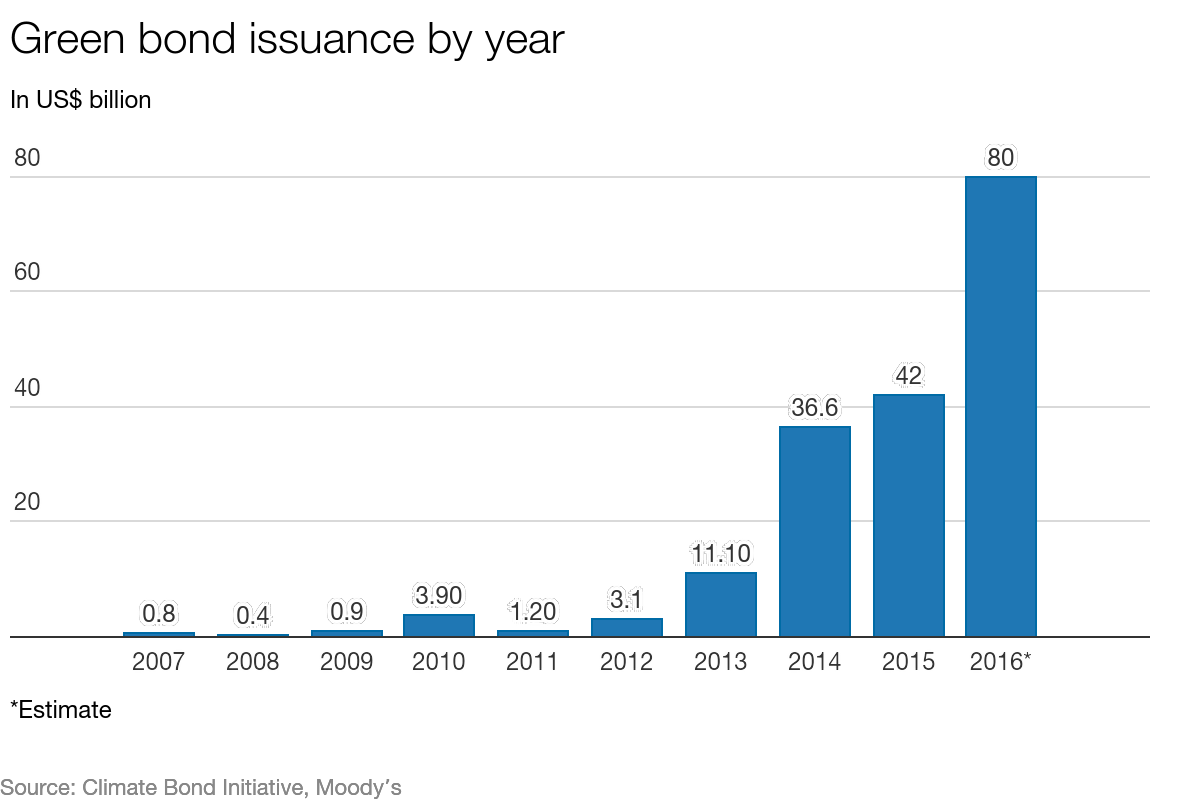

The rapid growth of the green bond market has sparked interest from many audiences.

What are green bonds? Using debt capital markets to fund climate solutions. Green bonds were created to fund projects that have positive environmental and/or climate benefits. The majority of the green bonds issued are green “use of proceeds” or asset-linked bonds.

In this new financial era, how can one ensure that the necessary investments are still coming?In addition, how can investors ensure that they are still receiving financial returns? Green bonds may very well be the solution.

The green bond market provides an innovative way to obtain both a financial return and receive a positive impact. The main characteristic of a green bond is that their proceeds are allocated exclusively to environmentally friendly projects.

According to HSBC, the green bonds market is rapidly increasing; around $80 billion worth of green bonds could be issued by the end of the year. This would represent almost a 100% year-on-year growth.

In this negative-yield bond era, green bonds represent quite a good deal; 82% of them are rated at investment grade and they satisfy the medium long-term preferences of institutional investors, as well as covering a broad range of sectors. Investors are drawn to both the liquid, fixed-income investments that green bonds offer and the positive impact that they can have.

Many institutional investors, such as pension funds, now have mandates for sustainable and responsible investments and are developing strategies that explicitly address climate risks and opportunities in different asset classes. Green bonds can provide the verification and impact measurement that investors need. In the case of World Bank green bonds and IFC green bonds, they also bring AAA ratings.