It's been a tough year for bonds so far. Of course, a tough year for bonds can be a tough day for stocks. But investors seem equally disturbed by a 2% loss in bonds as by a 10% or more loss in stocks, so it's worth looking at how bond funds have weathered the most recent storm. We looked at some of the most popular funds that reside in Morningstar's intermediate term bond fund category. That category contains funds whose duration is moderate and whose holdings tend to be almost all investment grade, and so those funds tend to be the workhorses of most investors' portfolios.

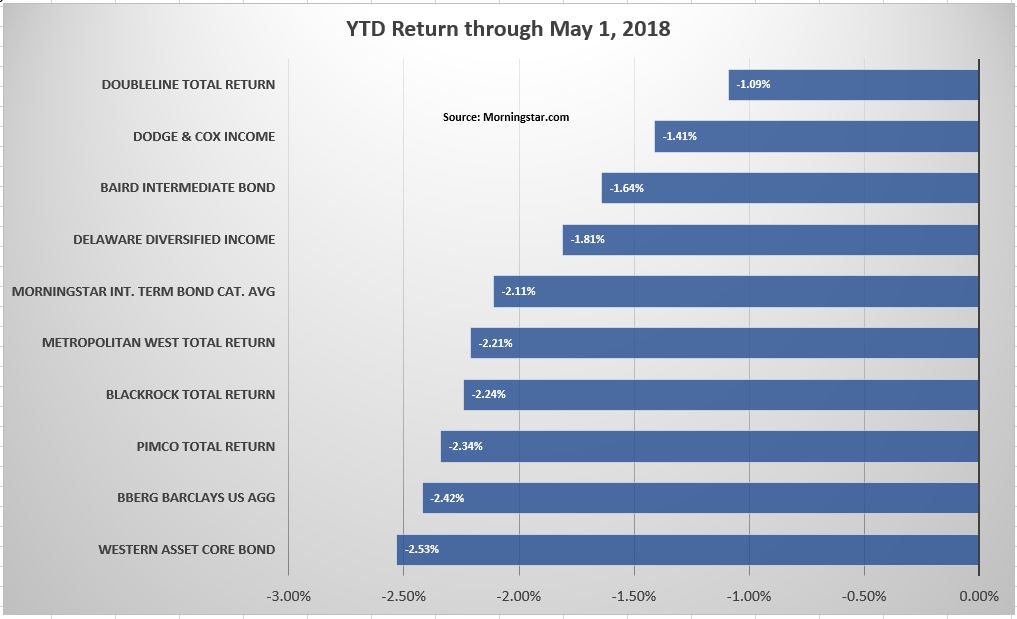

Through May 1, the Bloomberg Barclays US Aggregate is down 2.42%. That's a total return number, so it includes the difference in price plus interest payments. The Morningstar intermediate term bond fund category average is down 2.11%, a slightly better showing likely owing to the higher corporate bond exposure and slightly lower duration of many funds compared to the Treasury -heavy index.

Duration Hurts

First, all of our selected funds have beaten the index so far this year except for the Western Asset Core Bond fund. The fund's portfolio doesn't appear unusual, although it has more of its assets in Agency Pass-Throughs than its peers (35% versus 21%), according to Morningstar. It has nearly 22% of its portfolio in Government bonds, according to Morningstar. Almost all of that is in u.s. Treasuries with a small part scattered in U.S. Agencies and Non-U.S. government debt. Nearly 8% of the fund's portfolio is in emerging markets debt.

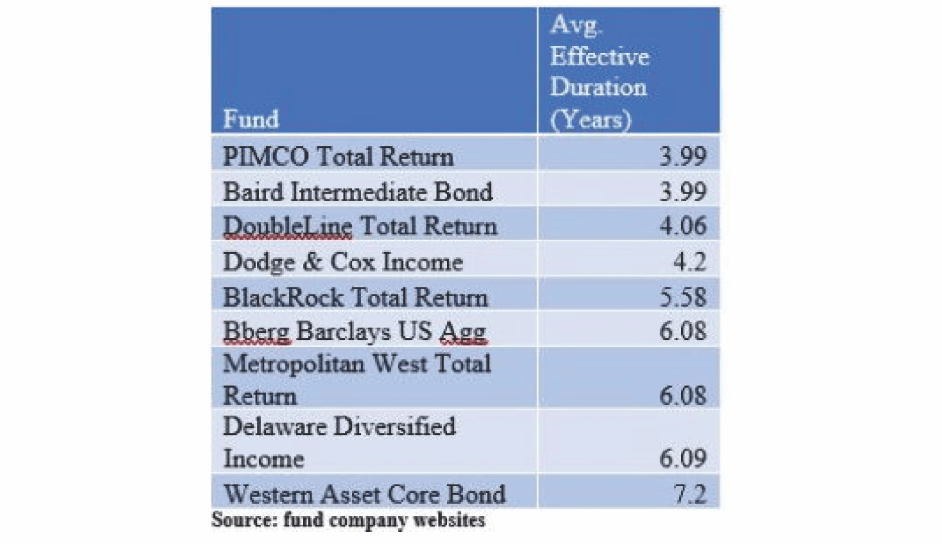

However, the fund's average effective duration, a measure of interest rate risk, is nearly seven years, and that has likely contributed to its underperformance. No other fund's duration is over seven, and the next highest three are barely over six. Five of the funds have durations around 4 years, and they've tended to hold up better this year.