Cryptocurrencies are an attractive investment market. The constant variation of the values assets in the crypto markets undergo can lead to huge profits over short periods of time. For example, bitcoin value was at $6,493 in October 2018 and at the time of this writing is valued at over $9,394 per coin. This resulted in considerable capital gains for traders and investors which always leads to the dreaded tax question.

Unfortunately, cryptocurrency taxes are an altogether less attractive subject, and can seem complicated and convoluted to those with less experience in the field. Misunderstanding the concepts and process of correctly calculating and reporting your gains taxes can lead to endless headaches from the IRS, and potentially subject you to costly suits. To save you that sort of hassle, and so that you can have a better understanding of the commodities you're trading, we've gone through the most important bits down below.

How Are Cryptocurrencies Taxed?

While many other regions of the world classify cryptocurrencies different, the Internal Revenue Service of the United States views cryptocurrencies as property. This means crypto is an investment like stocks or bonds, at least in regards to the method under which they are taxed. When selling off cryptocurrency, as with selling off stocks, a certain type of tax is assessed by the government. This special tax is called a capital gains tax.

What Are Capital Gains?

Capital gains are the value an asset has gained while you've owned it. For cryptocurrencies the tax on these gains is assessed when you trade or sell the coin, just like what happens when sell a stock that has increased in value over the time you've held it.

The amount you'll have to pay in tax changes based on a various number of factors, primarily the length of time you've held the investment. The government's goal with these capital gains tax brackets is to encourage long term investments, keeping markets somewhat more stable. We can put the brackets in two basic levels, investments owned for less than one year, short term investments, and investments owned for more than one year, long term investments. The capital gains tax on short term gains can amount to a rate of 37%, far greater than the maximum rate of 20% you'd be dealing with for long term gains.

When Are You Required to Report?

You become liable to report capital gains whenever a taxable event occurs. What exactly counts as a taxable event is determined by the IRS. As of 2014, they count the following acts as taxable events:

- Utilizing blockchain currencies as payment for goods and services. This gives you the added responsibility of noting the value of each of the exchanged assets at the time of the trade.

- Receiving cryptocurrency as income, either as an accepted payment for goods and services, or income stemming from mining.

- Selling cryptocurrencies in exchange for native fiat currency, specifically the US dollar.

- Exchanging between two types of cryptocurrency (e.g. Ethereum to Bitcoin). Like with using them for payment, this gives you the added responsibility of accounting for each asset's value as it was when the trade actually occurred.

When Do You Not Have to Report?

Not every action you take with your cryptocurrency is subject to capital gains tax, even though it may really begin to feel like it when browsing through the above list. The following acts will not be counted as a taxable event by the IRS:

- Exchanging fiat currency for cryptocurrency, just like when a stock is actually bought. Since the initial transaction of purchasing the coin doesn't confer any gains upon the buyer, the government has nothing to tax.

- Keeping cryptocurrency, often referred to as ‘hodling' in the crypto community. Gains taxes are only assessed when you do something to the asset. While you allow your assets to gain value you don't need to worry about the government trying to take a slice.

- Transfering cryptocurrency between exchanges or your own wallets. Since nothing is changing hands, no tax is assessed.

- If you actually want the cryptocurrency to change hands without having a tax assessed, you'll have to give it as a gift. Note that there is a limit on the value of non-taxable gifts, meaning you can't give cryptocurrency totaling in worth greater than $15,000 in US fiat currency. Though this isn't likely a limit the average gift giving trader would have to worry about.

How Do You File a Report?

Chances are your crypto activity has triggered a taxable event, so you'll need to report it in your crypto taxes.

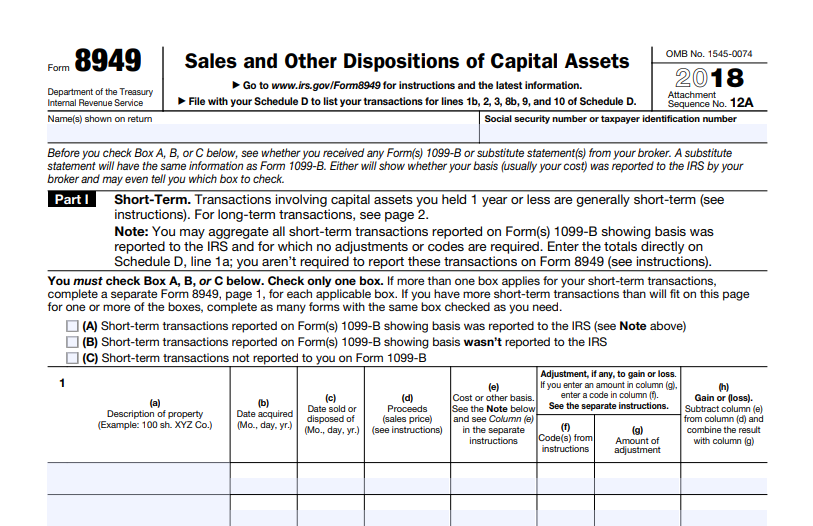

To do this, you'll need two forms in particular, namely IRS Form 8949 and 1040 Schedule D. Form 8949 needs to be filled with notations of all of the trades and sell offs that you've made, consisting of the date of transaction, the fair market value of your proceeds, the gain (or loss) incurred, and the cost basis of the assets involved. Once all trades are listed, they need to be totaled on the bottom of the form. This number is then transferred onto your 1040 Schedule D form. Ensure both of these forms are properly completed and filed with your yearly tax return to prevent tax headaches later on.

Tax Reports From Crypto Exchanges

You might think that the exchanges themselves would be able to provide their users with usable tax reports, but that isn't the case. Despite the fact that some of the biggest crypto exchanges provide these reports, they won't have all the needed information to be considered accurate.

This is because most users are trading on multiple exchanges. Whenever you transfer crypto out of one exchange and into another, neither exchange remains able to give you an accurate report of the market value or cost basis of your coins.

If you want to use the reports from your favored exchange, you'll need to use it exclusively.

Concluding Thoughts

Without prior understanding of the many confusing concepts relating to crypto tax law, the who process can be hard to push yourself through. But by taking the time to learn the basics, and by ensuring all your transaction records are properly kept, you can save yourself and your wallet from pain down the line.

This article is not financial advice. The content above is strictly the opinion of the author. Do thorough research before investing in any asset.