The Goldilocks Economy?

Timing this economy has the market on edge. With inflation nearing the Fed's 2% target, investors seemed relieved that the FOMC decided to hold off on hiking rates. In the ninth year of the 2nd longest expansion in u.s. history, it is surprising to hear the phrase “Goldilocks economy” in the news. Perhaps fitting, the old children's story tells of a little girl trying to profit before the bears come back home. During her breaking and entering, she finds three bowls of porridge, one too hot, one too cold, and one just right. With inflation growing at a moderate pace while unemployment dips under 4%, economists see the economy as not too hot and not too cold.

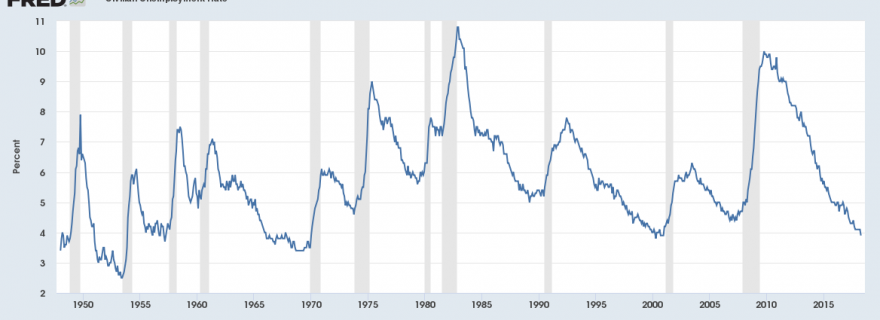

The Federal Reserve has dual mandates: keeping unemployment and inflation low. Unemployment recently fell to 3.9%, the lowest level since April 2000. The Fed has indicated that they see a long-run unemployment rate of 4.5% as healthy.

Source: BLS, FRED

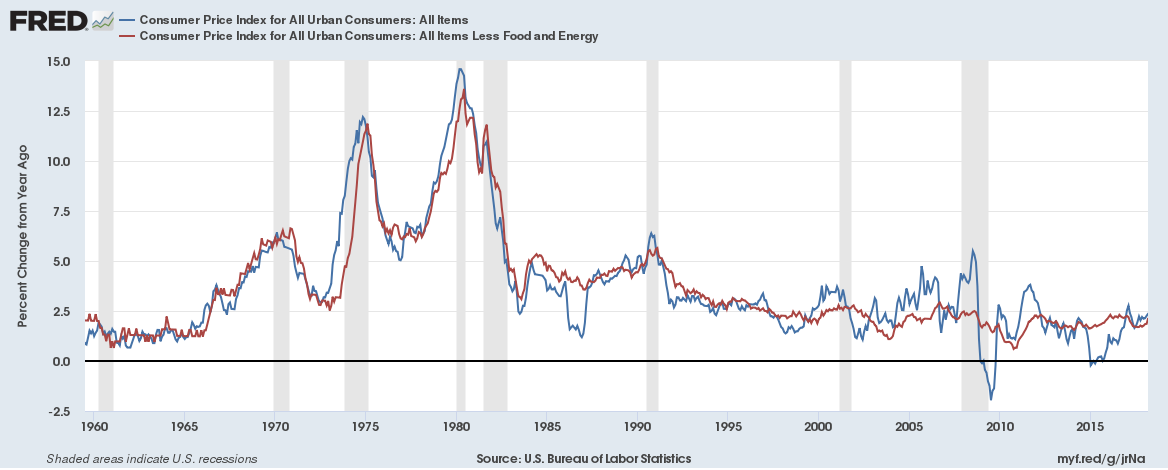

The Fed also aims for inflation of 2%. Most look to CPI as the benchmark, but the Fed typically watches the change in Personal Consumer Expenditures ex. Food and Energy. For reference, the Consumer Price index in March was 2.35% overall and 2.11% excluding food and energy (red line).

Source: BLS, FRED

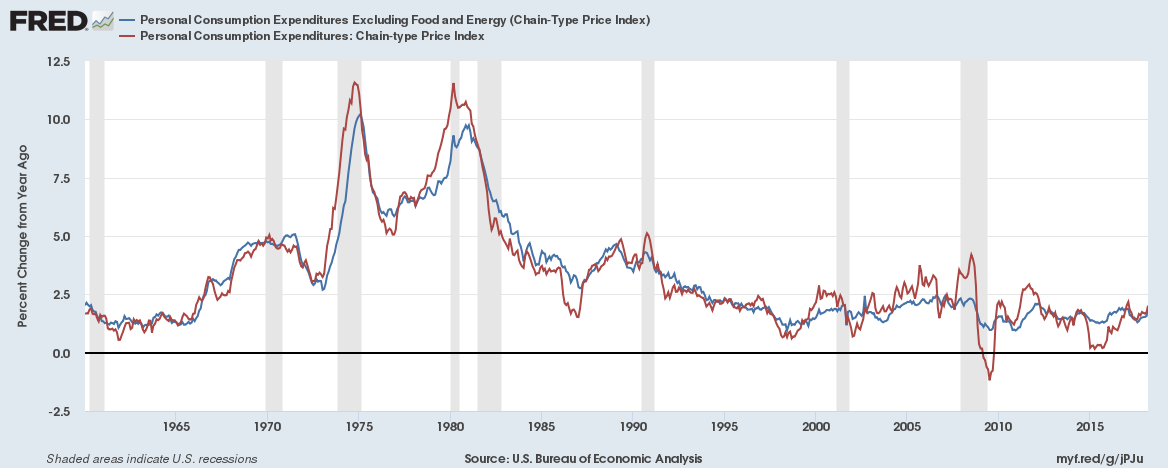

PCE readings were more muted, coming in at 2.01% overall, and at 1.88% for the less volatile PCE ex. Food and Energy (blue line). Both measures show inflation has been meandering rather than rising consistently. However, trying to time a recession (shaded areas) based on inflation looks like a fool's errand in the chart below.

Source: BEA, FRED

You Are Here

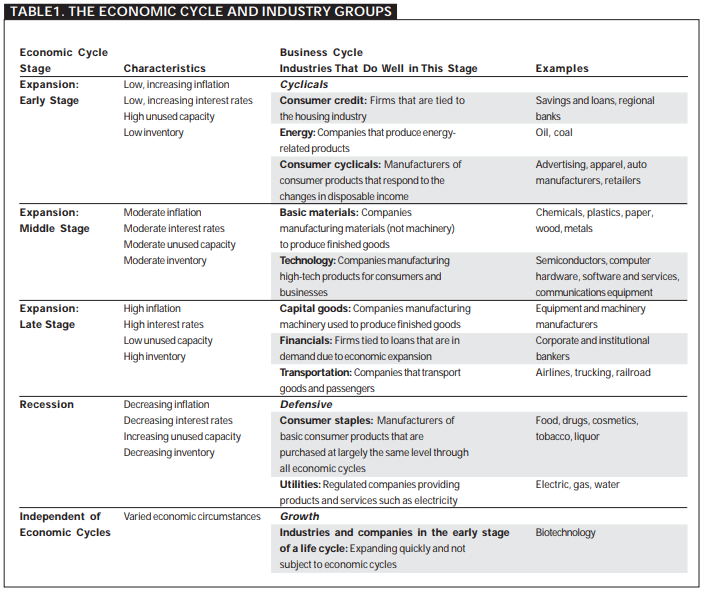

In an August 2003 article in the American Association of Institutional Investor's Journal, Wayne Thorp provided a framework for determining where to invest based on the economic cycle. He used four criteria for timing: inflation, interest rates, capacity, and inventory.

Source: August 2003 article

Inflation: As noted earlier, inflation is neither too hot or too cold. With the PCE benchmark somewhat close to the Fed's target, inflation can be categorized as moderate.

Interest Rates: Interest rates are relatively low across the spectrum; however, two spread measures have been helpful in pointing towards recessions. The 10-year minus 2-year Treasury spread has gone negative and then started to rise a few months ahead of the last three recessions, indicating a flattening and then inversion of the yield curve. Currently, the curve is flattening with the spread at 49 basis points.