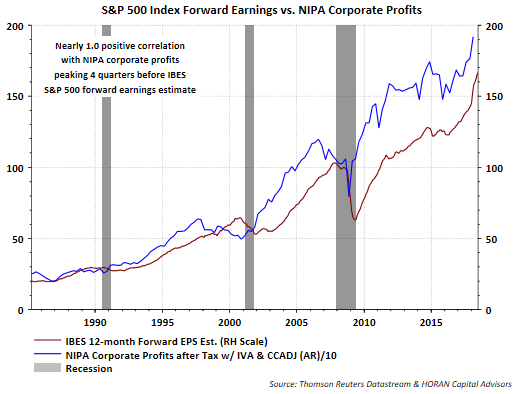

One aspect of the NIPA profit numbers is they tend to peak about four quarters before the I/B/E/S 12-month forward earnings estimates. With the strong growth in NIPA corporate profit it can be anticipated that I/B/E/S earnings growth will be favorable for the 12-months ahead, all else being equal.

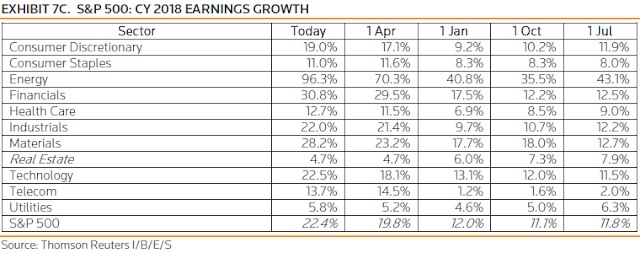

By now many have heard or read about the strong earnings growth in the first quarter of this year, up 26.6%. Certainly tax reform is having a favorable impact on corporate profits, but companies are reporting top line revenue growth as well. First quarter revenue growth is estimated to equal 8.4% versus the same period a year earlier. The below table outlines the progression of the higher earnings revisions for the calendar year 2018. On January 1, 2018 earnings growth estimates were anticipated to equal 12.0% for all of 2018. As of Friday's close though, earnings growth has been revised higher to 22.4% for 2018.

One would expect the market to react favorably to this rate of earnings growth. What may be occurring though is a market that is adjusting to a more normal level of earnings increases. The below table shows that earnings growth expectations for calendar year 2019 equals 9.7%, down from the strong 22.4% expected for all of 2018. Our belief at HORAN is the equity market may be correcting over time versus price as it adjusts to this more normal, but lower rate of growth for corporate earnings.