Call me crazy, but there seems to be a lot of chatter devoted to convincing us that we're not in a deflationary spiral. One of the main rationales behind QE was that quintupling the size of the federal reserve's balance sheet was necessary to engineer a “healthy” rate of inflation of at least 1-2%. Let's see what the numbers tell us (everything below is non-seasonally adjusted). If we believe that the core Consumer Price Index (CPI ex-food and energy) is the correct measure of inflation, then we're inflating:

On the other hand, if we believe that the Producer Price Index for Commodities is the correct measure, the trend may be changing from inflation to deflation:

And, if we prefer to examine at the prices of key agricultural and physical commodities directly, without “hedonic adjustments” by government bureaucrats . . .

. . . we see that oil, copper, soybeans, wheat and corn prices are all deflating, with average declines of -29% over the past 2 years.

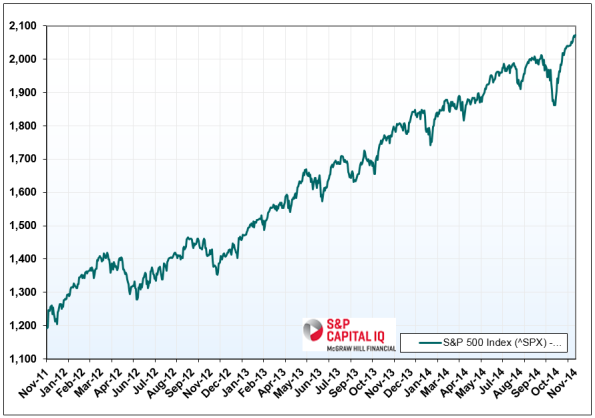

Which is not to say that QE has been completely unsuccessful in creating some inflation:

If you're not concerned, you're either not paying attention — or you're a money manager. Bill Gross may be a strange individual, but he's got a pretty good track record — see Bloomberg's coverage of Gross's deflationary forecast and Rich Miller's more recent outlook for Europe. I would recommend preparing for additional sudden volatility outbursts, at least as bad as what we experienced during October 2014's short-lived “correction.”