The word play in the title is in reference to the ridiculous fuss over COMEX gold inventory and other promotions masquerading as fundamentals put out by cartoons masquerading as analysis.

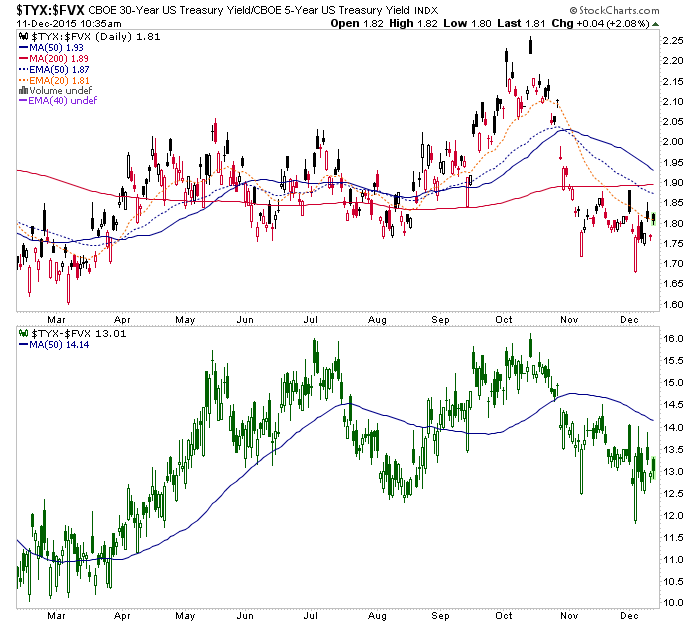

30 year divided by, and 30 year minus 5 year are neutral at best. Yield spreads would be rising in a gold-positive environment. As a side note, this spread also tends to bring trouble for the stock market during its initial stages of rising.

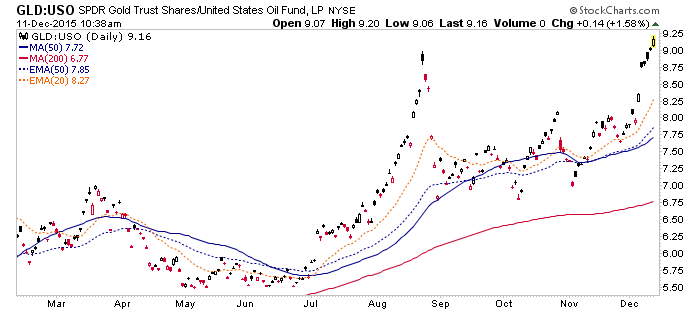

Gold vs. Crude Oil is getting bullisher and bullisher for the gold mining industry.

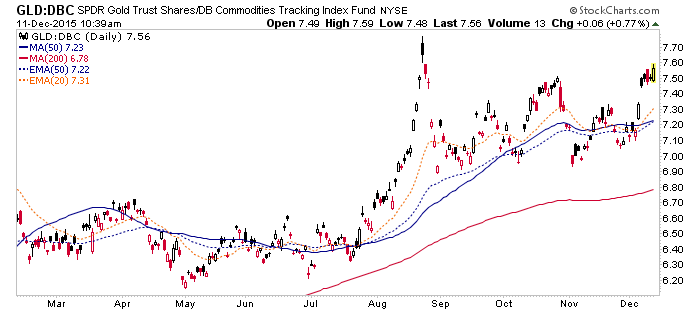

Gold vs. Broad Commodities is also looking bullish.

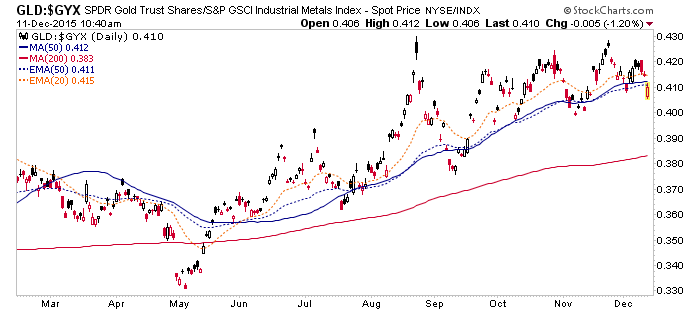

Gold vs. Industrial Metals is a little wobbly, but in an uptrend for months now.

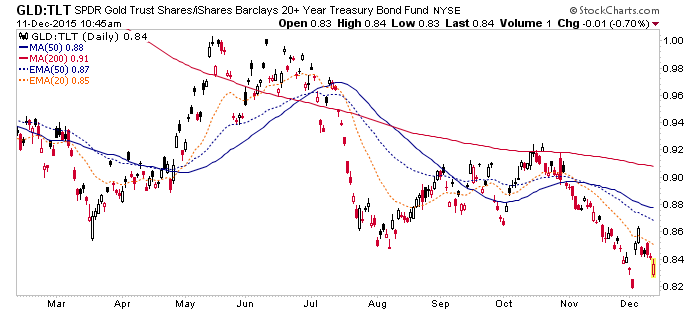

Gold is still not preferred for safety in relation to Uncle Sam himself. The implication is that confidence is intact in government, in policy makers, in the whole ball of wax. That's okay, we've got time (and patience).

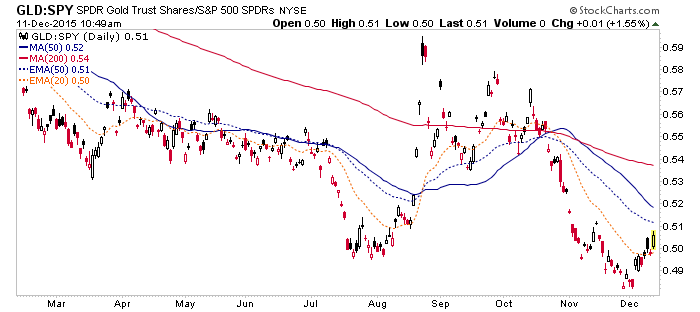

Gold is once again bouncing in SPX units. When this trend changes a major macro fundamental underpinning will be in place for the gold stock sector. This is at this point a bounce, not an uptrend.

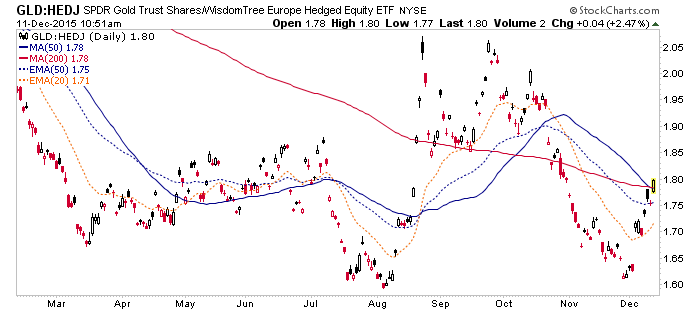

Gold vs. Euro-hedged European stocks is the kind of chart that makes me think‘hmmm, a trend change has got to start somewhere… but as yet, no trend change.

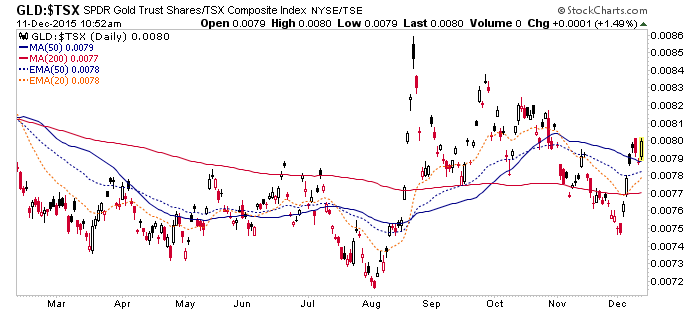

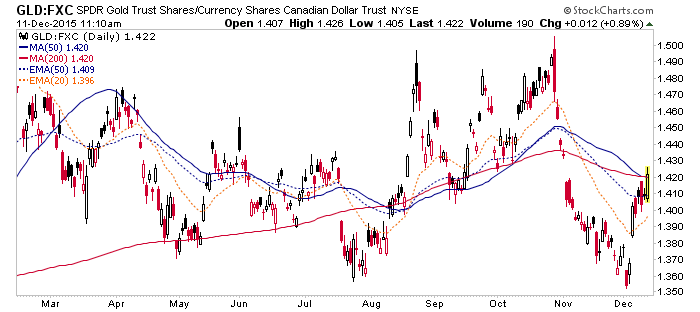

Gold vs. un-hedged Canada is better still.

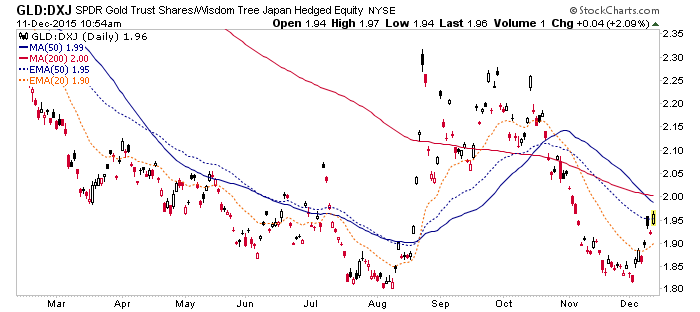

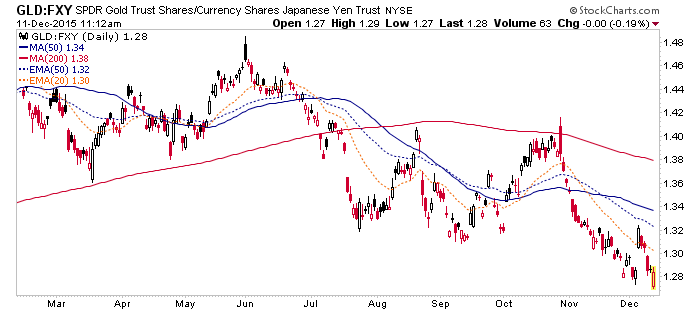

GLD vs. Yen-hedged Japan is bouncing.

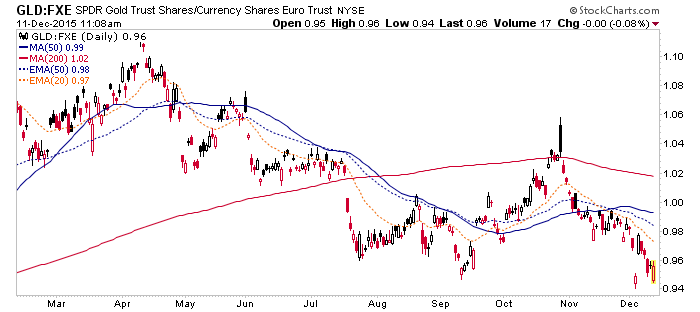

Gold vs. a currency that is actually under attack by the ECB, is bearish.Imagine that, this chart would tell Europeans to own the currency that is being devalued by policy makers instead of owning gold.

Canadian gold owners are once again bouncing vs. Canadian dollar owners.

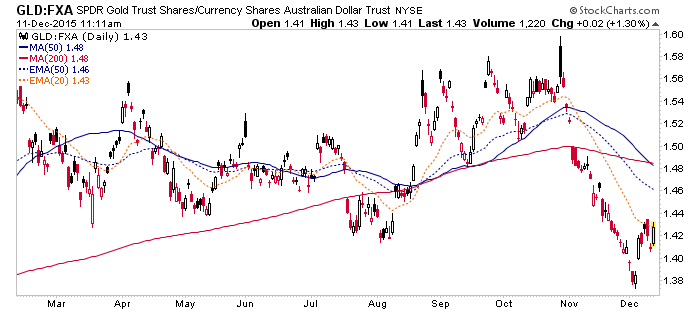

Gold vs. Aussie, not so much.

Gold vs. Yen has Japanese saying “buy Japanese stocks, I'm not going to help you”. Oh wait, Japanese stocks are correcting a bit as well.

Maybe Japanese might just want to hold Yen for a while until the dust settles.