What do you know? The BoJ is holding firm this time (unlike Q4 last year when they blew up the Yen and were part of what seemed a coordinated effort along with China Central Planners' easing and Fed Hawk-in-Drag Bullard's ‘QE 4' bull horn) to keep deflation at bay and asset markets afloat.

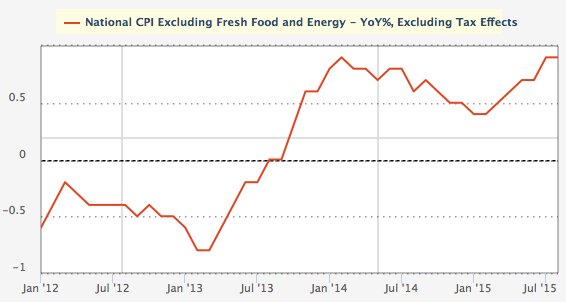

This time Mr. Kuroda notes that prices are not declining as they were back then. Here is the graphic from the excellent site Japan Macro Advisors (thanks to subscriber JF for the link)…

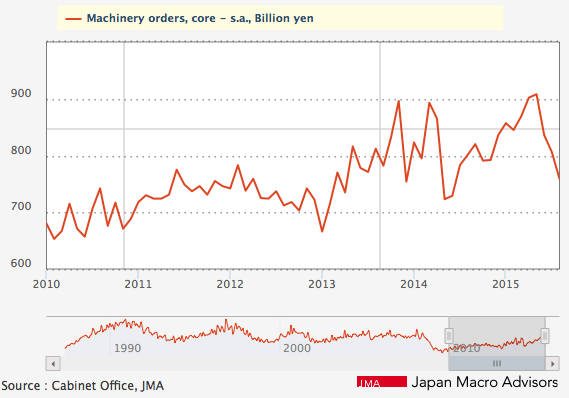

Meanwhile, Machinery Orders Continue to Plummet, also per JMA…

Being a former manufacturing person, I was very sensitive to the machine tool deceleration back in July when alerted by a former associate that Mori Seiki was going into the tank (blowing out machine tools at or below cost, a Japanese tradition when facing downturns). Here was the July post on the subject, including a look at Fanuc's declining business.

On Japan, Robotics, Machine Tools & Manufacturing

Fanuc was by the way the target of some Wall Street ‘Robotics' hype right before the downturn. This hype was less egregious than the dangerous stuff going on in 3D Printing that we warned about at the top of that hysteria. I actually like progressive manufacturing companies like Fanuc and Faro, but hype is hype and it kills.

Given the macro data coming in, it appears reality continues to correct the excesses.