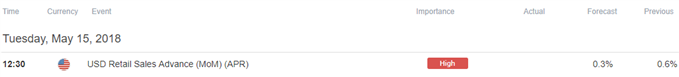

Fresh updates to the U.S Retail Sales report may fuel a larger rebound in EUR/USD as household spending is expected to narrow in April. A marked slowdown in private-sector consumption may sap the appeal of the greenback as it remains one of the leading drivers of growth, and the Federal Open Market Committee (FOMC) may stick to the current forward guidance for monetary policy as ‘inflation on a 12-month basis is expected to run near the Committee's symmetric 2 percent objective over the medium term.'

Even though the FOMC is widely expected to deliver a 25bp at the next quarterly meeting in June, recent comments from Chairman Jerome Powell and Co. suggest the central bank is in no rush to extend the hiking-cycle as ‘the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run.' In turn, a set of lackluster data prints may generate a mixed reaction, with the greenback at risk of facing headwinds as market participants scale back bets for four Fed rate-hikes in 2018.

Nevertheless, an above-forecast print for U.S. retail sales may trigger a bullish reaction in the dollar as it puts pressure on the FOMC to adopt a more aggressive approach in normalizing monetary policy.

IMPACT THAT THE U.S. RETAIL SALES REPORT HAS HAD ON EUR/USD DURING THE LAST RELEASE

Period

Data Released

Estimate

Actual

Pips Change

(1 Hour post event )

Pips Change

(End of Day post event)

MAR

2018

04/16/2018 12:30:00 GMT

0.4%

0.6%

+30

+19

March 2018 U.S. Retail Sales

EUR/USD 5-Minute Chart

Retail spending climbed 0.6% in March following a 0.1% contraction the month prior, while the core measure for retail sales, which excludes auto and gas, increased another 0.3% during the same period amid forecasts for a 0.4% print. A deeper look at the report showed demand for motor vehicle, parts increasing 2.0% to lead the advance, with spending on health/personal care increasing 1.4%, while discretionary spending on clothing slipped 0.8% after rising a marginal 0.2% in February.