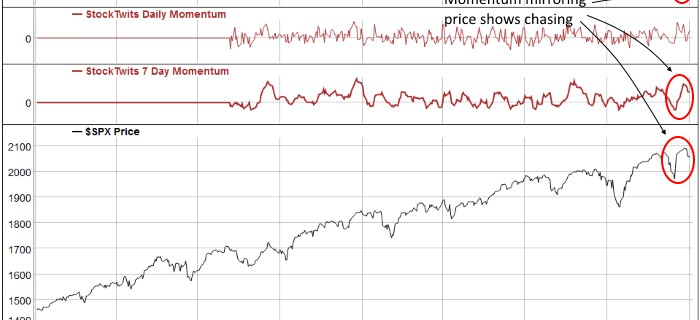

Over the past few weeks, subscribers to Trade Followers have been watching market participants chase price as momentum from both StockTwits and Twitter moved up to extremely overbought levels. 7 day momentum on Twitter for the S&P 500 Index (SPX) reached a level that generally precedes a decline of several percent. The pattern of chasing from traders adds some instability and indicates that the daily moves in price will most likely be larger than we've seen in recent months.

Support and resistance levels gleaned from the Twitter stream show very little support below current levels. Long time readers know that this condition often leads waterfall type declines because investors don't have price targets for new purchases.

Breadth calculated from the Twitter and StockTwits streams continues to deteriorate and paint a negative divergence from price. However, the current levels are still healthy. The healthy readings are mostly a result of a lack of stocks in the most bearish lists. Although the number is rising, it's doing it slowly. Keep an eye on the most bearish list over the next few weeks because it will give clues to the severity of the current decline.

The overall message from social media is that the market needs to at least consolidate. The market is also at risk of larger price swings and possibly a waterfall decline due to the lack of support levels being tweeted below current prices. In short, this is a time for caution.