Is it just me or have there been a whole bunch of really scary sounding stories about rising interest rates in the last few months? While some of these worries are warranted it's important to pan out and take a more objective view of the environment so we can avoid making excessively short-term judgements about what may or may not happen. There's a lot of people out there who rely on selling you short-term fear in exchange for your attention and your money. So let's see if I can save you some money and some stress by putting things in a reasonable perspective.

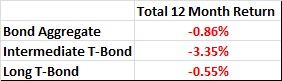

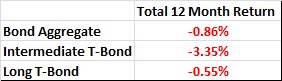

In the last 12 months 10 year bond yields have jumped from 2.2% to 3.05%. Short rates are up even more with the 3 month T-Bill jumping from 0.9% to 1.9%. Sounds like a scary time to be a bond investor, but it really hasn't. Here's the 12 month total return on various bond instruments:

That's not even a flesh wound. Of course, as I've described on several occasions, bonds don't necessarily lose value when rates rise. Bonds lose value in the short-term when rates rise, but rising rates ultimately lead to higher future bond returns as your long bonds become short bonds which then get reinvested in higher yielding bonds.

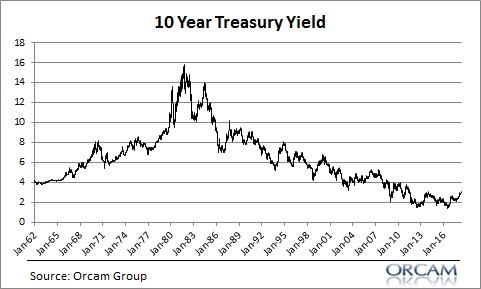

Importantly, the recent rise in yields hasn't been extreme at all. In fact, this looks like another garden variety counter-trend move that barely registers on a long-term chart of yields:

But the real kicker here is understanding that the total return on bonds has been pretty muted despite rising rates. That's because the rate of change hasn't been dramatic by any means. And for bond returns the rate of change in yields and the starting point is everything. In a sharply rising rate environment the interest paid does not always offset the loss in principal.

For instance, if you bought an aggregate bond index one year ago you were buying an instrument that paid about 2.25% with an average effective maturity of 5.9 years. But rising rates have resulted in a 3.11% principal decline leading to a total return of -0.86%. And of course, if you actually hold onto this bond for 5+ years there's very little chance you'll see principal losses because the underlying bonds will mature at par and you'll recoup your short-term principal declines plus you'll earn the interest all along the way.