Q1 Wrap Up

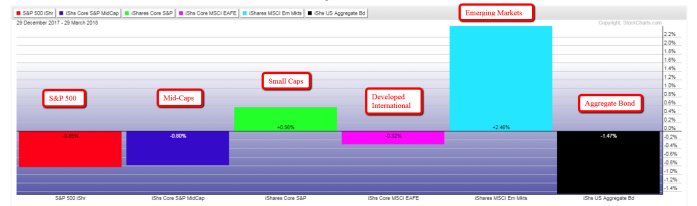

The 1st quarter saw a return of volatility,ending a 9 quarter win streak. Most asset classes finished lower for the quarter, led by the aggregate bond index. Emerging markets and small caps finished positive.

Diversification works over time, that much we do know. However, that doesn't mean it works every day, month, quarter, or year for that matter. Long term investors shouldn't be dismayed, or surprised, when asset classes act in unison at times. Stay diversified, and don't chase performance.

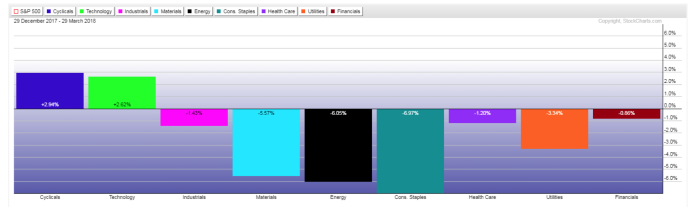

From a sector level, technology and consumer discretionary were the only two sectors to close with gains for the quarter. The weakest sectors were the rate sensitive consumer staples and utilities, along with energy and basic materials.

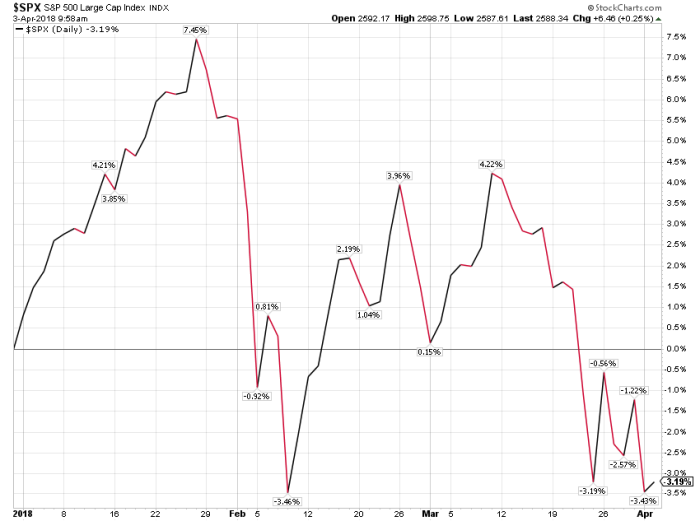

Much has been made about the recent volatility in the markets. But it's not nearly as bad as it's been made out to be. For example, the Dow closing down 1,000 points in one day sounded awful. But in reality, when the Dow is near an all time high above 20,000, a 1,000 point daily move is only about 4%. 4% isn't fun, but it's certainly far from a doomsday scenario. The 1987 crash experienced a 22% decline in one day, even though the decline in points was less, it was far more impactful than anything we've seen.