For several weeks now, we (NFTRH) have been managing the potential for a bounce in the precious metals. This was primarily based on over sold readings, a gold bug ‘puke' event in mid-July and outstanding CoT alignments for both gold and silver.

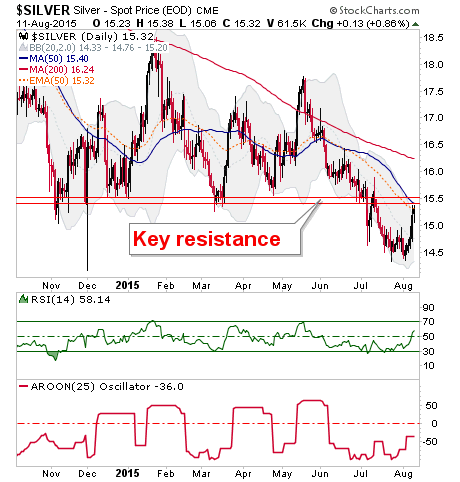

Targets were gold 1140 and silver around 15.50 [1]. Gold still has a way to go, but silver is just about there.

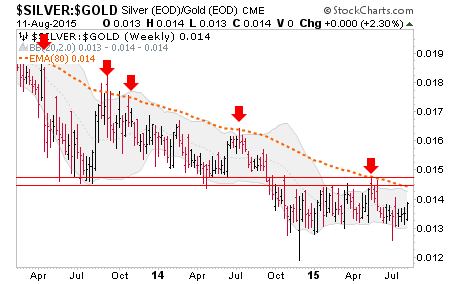

While we used a constructive looking daily chart of silver vs. gold to manage the coming bounce in an update last week, it is the weekly that will control the big trend in the relationship between these two metals and their implications on inflation, commodities and even many global markets. Silver remains in lock down vs. gold.

Post now shifts to ramble mode…

A couple things to beware right now. The first is obvious, Keynesian propagandists trying to paint global problems as a discrete ‘China thing' or ‘commodities thing' or ‘EM thing' and the second is any chartist trying to tell you that everything you need to know is in any nominal chart.

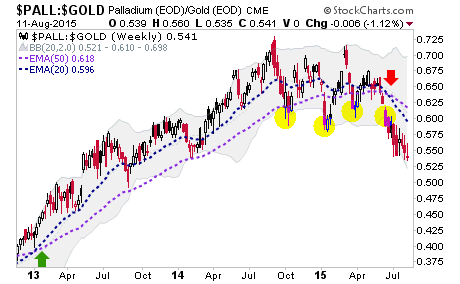

It is all about relationships right now; the relationships between global economies, financial systems, competitively devaluing currencies, debt leveraging operations and asset markets. It is also about market indicators like Silver-Gold above or Palladium-Gold below.

These act like “metallic credit spreads” [2] and indicate both positive and negative macro market backdrops to come, giving plenty of warning, as PALL-Gold did early in 2013 to the upside and is doing currently [3] to the downside.

As for Silver-Gold, it never did break through resistance and this has meant ‘hands off!' commodities and the ‘inflation trade'.

[1] Whether just a bounce or something more, these were the initial targets.

[2] Again I tip the hat to Bob Hoye for this excellent term.

[3] Well, it is kind of late now for sleepy casino patrons, but NFTRH noted the chop and grind all through the last year, and finally the trigger down a few months ago.