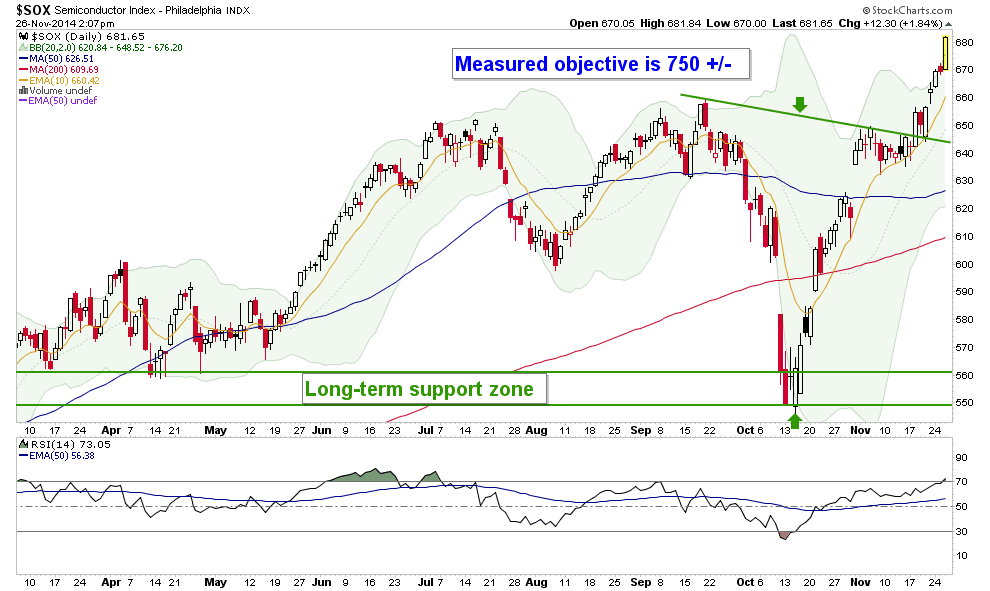

Way 1 is the short-term view showing the wild recent history of a huge drop, instigated by one chip company's dour projection and then a whole media hype pig pile. The target is 750 based on this pattern, roughly corresponding with the NFTRH+ target of 40 on Intel.

Click on picture to enlarge

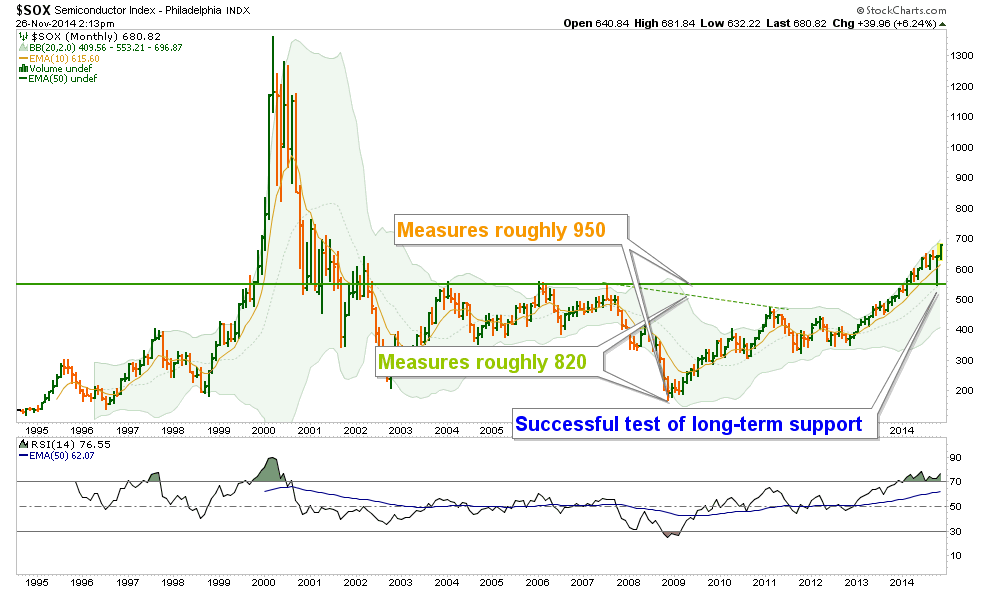

Way 2 is the big monthly view, which we have been using since starting to get constructive on the Semi's nearly 2 years ago. You may also recall that we talked about the index's creep up the top monthly Bollinger Band line as it did in 1999, prior to the big blow off. The October correction ripped it off that line but good. On the recovery SOX is seeking out that line once again.

The lunatic targets we showed over a year ago when SOX was threatening the big break out are still in play.

Click on picture to enlarge

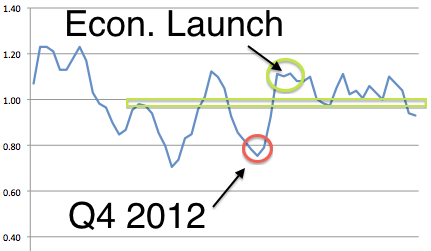

All this excitement is juxtaposed against a fledgling negative trend in the Semi Equipment companies' book-to-bill ratio (b2b).

The current market is really exciting because it seems to be choosing an upward direction for stock prices while at the same time things like the Semi b2b degrade. Manufacturing is starting to fray just a bit at the edges and overall market sentiment is too bullish and stands to get more so.

On a micro situation, if the b2b continues down and yet equipment makers run with the SOX… what what does that tell you? On a macro view the implication of rising stocks against potentially worsening fundamentals would be a sign that the whole market is setting up for something big, and negative.

Think Silver 2011 folks.

These are things that macro watchers should be on alert for. Casino patrons will get lost in the momentum, but macro watchers should be patiently watching macro fundamentals as juxtaposed against stock prices.