I can hardly remember the last time I woke up to a red NQ, red ES, and red ZB (bonds). I think it was about thirteen or fourteen years ago. But it's a delight to hold, and of course, I'm grateful to the obvious impetus behind this move.

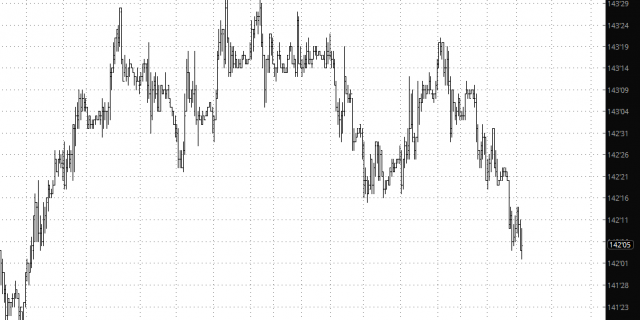

In particular, the weakness in bonds is key (as you well know by now). Here's the close-up view, and as I'm typing this, bonds are down about six-tenths of a percent.

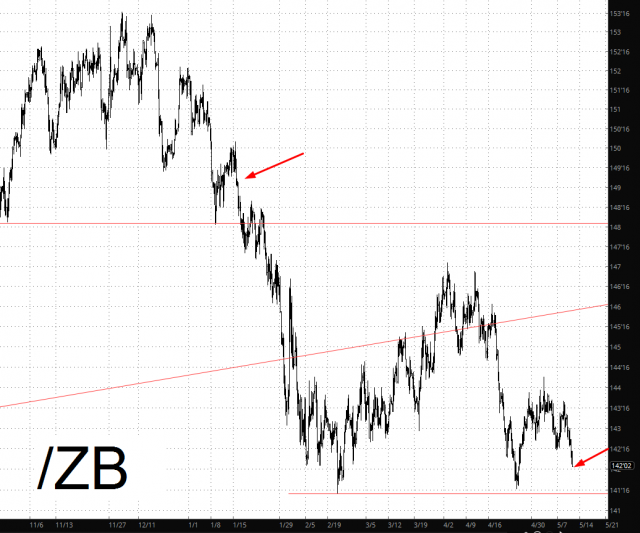

Take special note of its relative position, however. See the arrows indicate the analogous setup, and my anticipation of the break below the next horizontal.

One can more fully appreciate the setup with a multi-year view.

My thesis has been constant. Weak bonds —> rising rates –> suffocating equity values.