Recap from February's Picks

On to March's Picks

Our Most Attractive stocks for March were made available on March 5. Our Most Attractive stocks have high and rising returns on invested capital (ROIC) and low price to economic book value ratios.

Most Attractive Stock Feature for March: Teva Pharmaceuticals (TEVA)

One of the new additions to our Most Attractive stocks list for March is Teva Pharmaceuticals (TEVA), an Israeli pharmaceutical company and the largest generic drug manufacturer in the world. The stock is up 9% this year. While Teva has a challenging 2015 ahead of it, we're confident in this company's ability to weather the storm and to continue to deliver value for its shareholders as it has done for years.

A Relatively Unknown Winner in Pharmaceuticals

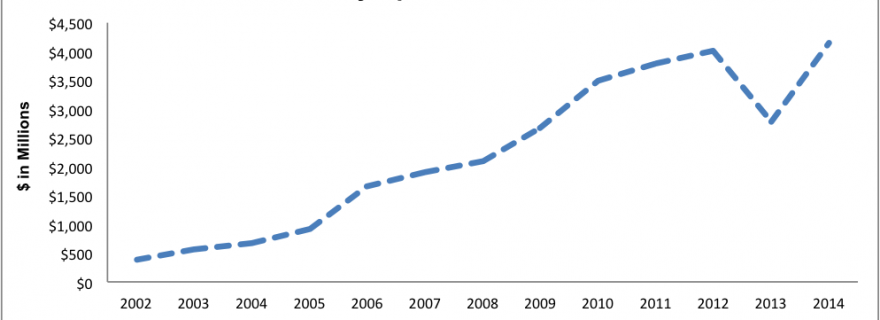

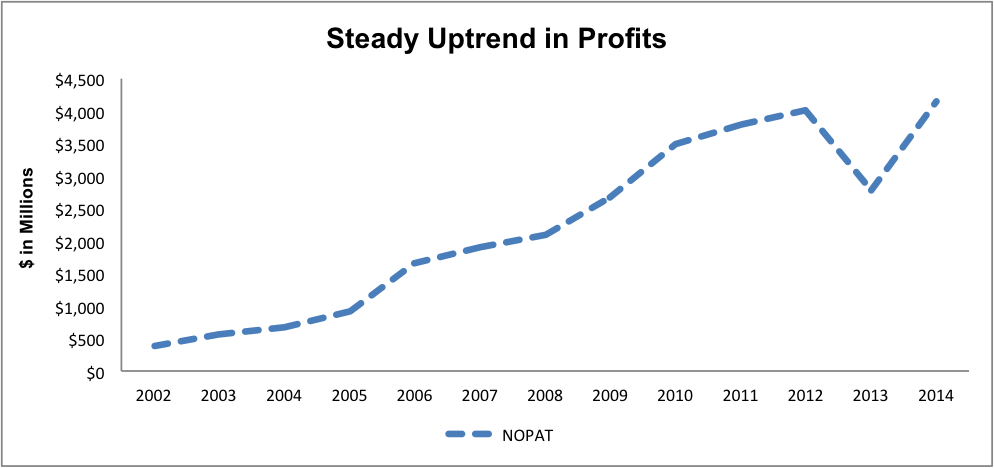

Since 2002, Teva has grown net operating profit after tax (NOPAT) by an impressive 22% compounded annually. The driving forces behind this growth have been 1) Teva's dominance in the generic drugs market and 2) sales of Copaxone, Teva's groundbreaking treatment for Multiple Sclerosis. In 2014, Teva produced 14% of all generic prescriptions in the United States.

Figure 1 provides a look at how Teva has grown NOPAT since its public listing in 2002.

Figure 1: Teva's Long Term Success

Source: New Constructs, LLC and company filings

Teva currently earns an ROIC of 10%, up from 9% in 2012. NOPAT margins are near historic highs at 21% while revenue was mostly flat in 2014. 2014 also saw Teva hit new highs in terms of free cash flow, over $4.7 billion, while its margins and ROIC were strong in the face of flat sales.

Like many pharmaceutical companies, Teva has taken on a large amount of debt — $12 billion, or over 23% of Teva's market cap — to fund its research and acquisition efforts. However, Teva's abundant free cash flow discussed earlier should ease concerns about servicing its debt.