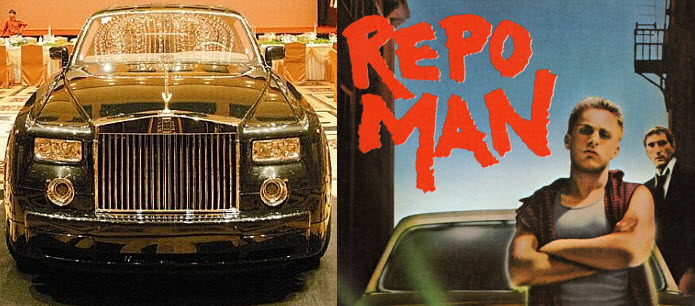

Because nothing says “recovery” like the record-breaking surges in sales of Rolls-Royce luxury vehicles juxtaposed by the

highest level of auto loan delinquency since the 2008 crisis peak…

On the one hand… (as MarketWatch notes)

Rolls-Royce Motor Cars posted a 12% increase in 2014 global sales, hitting a record 4,063, and the company's chief executive expects more growth in 2015 as demand for highly customized luxury sedans grows.

…the auto maker is contributing “significantly” to parent BMW AG's (BMW.F) profits, says Torsten Müller-Ötvös, CEO of Rolls-Royce Motor Cars, in an interview Tuesday following the release of sales figures.

…the average car sells for more than $250,000 and often much higher as buyers heavily customize their vehicles, leading to healthy margins.

Indeed, the so-called “bespoke” customization of its vehicles has become the key enticement for customers.

Mr. Müller-Ötvös said customers fly into the Goodwood, England headquarters and start the ordering process months in advance of receiving their vehicles. Some customers even have the cars flown home with them.

Customers have had thousands of tiny LED lights installed into the ceiling of cars to reflect the constellation on the day of their birth–accented with diamonds. That is in addition to things like cigar humidors and refrigerators that are de rigueur in super luxury cars.

To increase its capabilities, Rolls has added 200 workers in 2014 to work on customization. The company has 1,500 total employees in Goodwood.

North America was Rolls Royce's biggest market, but a dealership in Abu Dhabi was its top seller. With 127 dealerships globally, most retailers sell only a few dozen cars a year.

highest level of auto loan delinquency since the 2008 crisis peak…

Borrowers who took out auto loans over the past year are missing payments at the highest level since the recession, fueling concerns among regulators, analysts and some in the car industry that practices that helped boost 2014 light-vehicle sales to a near-decade high could backfire.

“It's clear that credit quality is eroding now, and pretty quickly,” said Mark Zandi, chief economist at Moody's Analytics.

More than 2.6% of car-loan borrowers who took out loans in the first quarter of last year had missed at least one monthly payment by November, the highest level of early loan trouble since 2008, when such delinquencies rose above 3%, according to an analysis of data performed for The Wall Street Journal by Moody's Analytics.

The uptick comes amid an increase in subprime auto loans, raising concerns that car buyers may have taken on more debt than they can handle. For that set of borrowers, defined as consumers with a credit score lower than 620, loan performance also is deteriorating.

More than 8.4% of borrowers with weak credit scores who took out loans in the first quarter of 2014 had missed payments by November, according to the Moody's analysis of Equifax credit-reporting data. That was the highest level since 2008, when early delinquencies for subprime borrowers rose above 9%.

Of the 15 biggest U.S. auto-lending banks, Santander (SAN) had the largest percentage of delinquent auto loans in the third quarter, according to SNL Financial. Santander's delinquency rate of 16.7% was followed by Capital One at 6.6%, according to SNL.

Of particular concern are loans in which car dealers push financing at extended terms of six and seven years at relatively high interest rates, even if the borrowers have weak credit and escalated debt-to-income ratios. The longer loan terms keep monthly payments under control and get buyers to purchase more expensive cars.