Following futures positions of non-commercials are as of June 26, 2018.

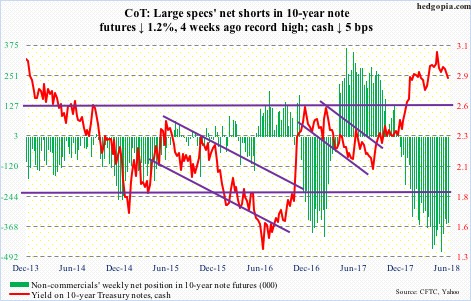

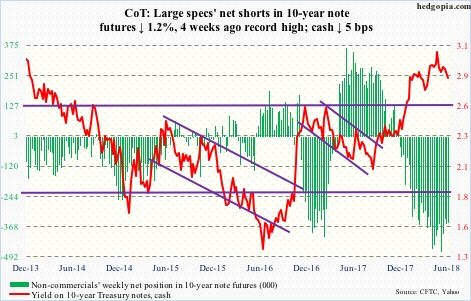

10-year note: Currently net short 355.3k, down 4.1k.

Core PCE – the Fed's favorite measure of consumer inflation – rose 1.96 percent year-over-year in May. This is as good as two percent. The last time it rose with a two handle was in April 2012. Core inflation has been trending higher since last September. This includes core CPI, which is already past two percent.

The FOMC dot plot which in the meeting this month forecasted two more hikes this year – four in total – is looking like it is on to something. Except there is that reaction from bond vigilantes. Friday, 10-year Treasury yields (2.85 percent) reacted to the core PCE print with pretty much a yawn, as if warning the central bank not to get too excited by the recent uptick in inflation. Ditto with the 10s/2s yield curve, which at 31 basis points Wednesday was the lowest since August 2007.

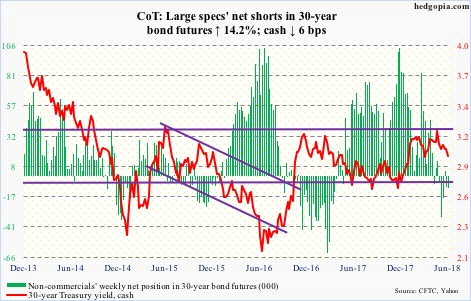

30-year bond: Currently net short 10k, up 1.2k.

Major economic releases next week are as follows. (US Markets are closed Wednesday. Happy Independence Day!)

The ISM manufacturing index for June is scheduled for Monday. May was up 1.4 points month-over-month to 58.7. February's 60.8 was the highest since 61.4 in May 2004.

Revised durable goods data for May, as well as non-durable, will be published Tuesday. Preliminarily, orders for non-defense capital goods ex-aircraft – proxy for business capex plans – in May rose 6.1 percent y/y to a seasonally adjusted annual rate of $67.9 billion.

Thursday brings the ISM non-manufacturing index (June) and FOMC minutes for the June 12-13 meeting.

Services activity in May rose 1.8 points m/m to 58.6. January's 59.9 was the highest ever (data only goes back to January 2008).

June's employment numbers are reported Friday. Non-farm payroll in May increased 223,000.

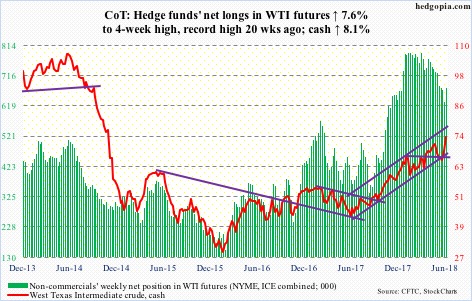

Crude oil: Currently net long 677.9k, up 47.8k.

Last week's weekly bullish engulfing candle on spot West Texas Intermediate crude ($74.15/barrel) was followed by another long-bodied solid black candle. Post-OPEC (plus Russia, among others) decision last Friday to boost production from July by one million barrels/day, traders have fallen over each other to own oil. For the week, WTI rallied another 8.1 percent.