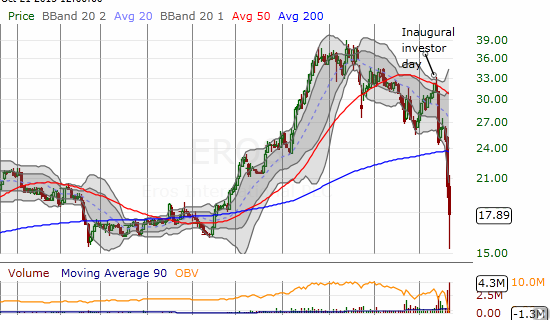

On October 13, 2015, Eros International, Plc (EROS), a major distributor and producer of Indian entertainment, held its inaugural Investor Day. The stock has been plunging ever since.

EROS inauspiciously failed at 50DMA resistance as its investor's day got started. In the 6 trading days since then, the stock is down a whopping 42%.

Source: FreeStockCharts.com

I have been tracking this stock ever more closely since the first big drop. I enjoy Bollywood flicks, Bhangra, and Indian pop music, so I am surprised I never heard of this company before. Sensing a buying opportunity, I have scrambled to play catch-up. I have searched and searched for news explaining the plunge. There are no explanatory SEC filings. In fact, the company just released news its reached 30 million registered users as of September 30th..something already announced during the Investor Day. I suspect this was a thinly veiled attempt at providing some kind of reassurance.

I have bugged friends and come up with nothing. Even on social media, I have found little to unfold the mystery of this plunge. I finally went back to the materials the company provided for its Investor Day. It was full of the bullish information one would expect on the company's financials and market opportunity – no obvious blemishes.

EROS is all about the flash and style of Indian entertainment

Source: EROS

I watched a short video featuring an interview with founder and Chairman Kishore Lulla on CNBC just ahead of the Investor Day in New York City. The discussion barely touched on any headwinds for the company. Here are my notes: