Introduction

This paper discusses the simple but effective method of using adaptive allocations between stock market ETFs and Treasuries. This method has been developed to replace the 100% switching used in normal rotation strategies like the Maximum Yield Rotation and the Global Market Rotation strategies.

The real world is just not a 100% “risk on” or “risk off” world. Most of the time, the best allocation is somewhere in between. The new method can be adapted for nearly all types of rotation strategies and is significantly increasing the return to risk (Sharpe) ratio of such strategies.

The SPY-TLT Universal Investment Strategy is very simple but also very effective. I am sure, such a simple investment strategy will nearly always perform better than any manual asset picking.

The UIS strategy

Probably the most basic of all rotation strategies, is the switching strategy between the S&P 500 US stock market (SPY) and long duration Treasuries (TLT). The SPY-TLT ETF pair is very interesting, because most of the time these two ETFs profit from an inverse correlation. If there is a real stock market correction, then Treasuries like TLT have always been the assets where money flows in, rewarding holders with nice profits.

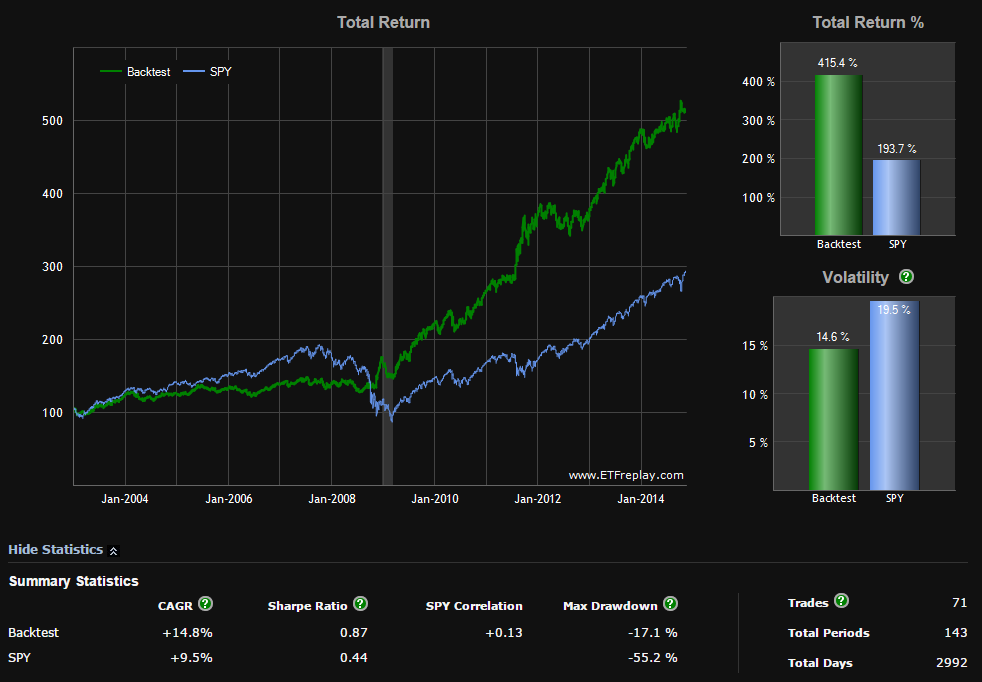

Now there are two possibilities to profit from this inverse correlation. The first is a switching strategy, which always switches to the ETF which had the best performance during the previous 3 months. This really simple switching strategy between TLT and SPY gave you a 14.8% return during the last 10 years, with twice the Sharpe ratio (return to risk) ratio of a simple SPY investment.

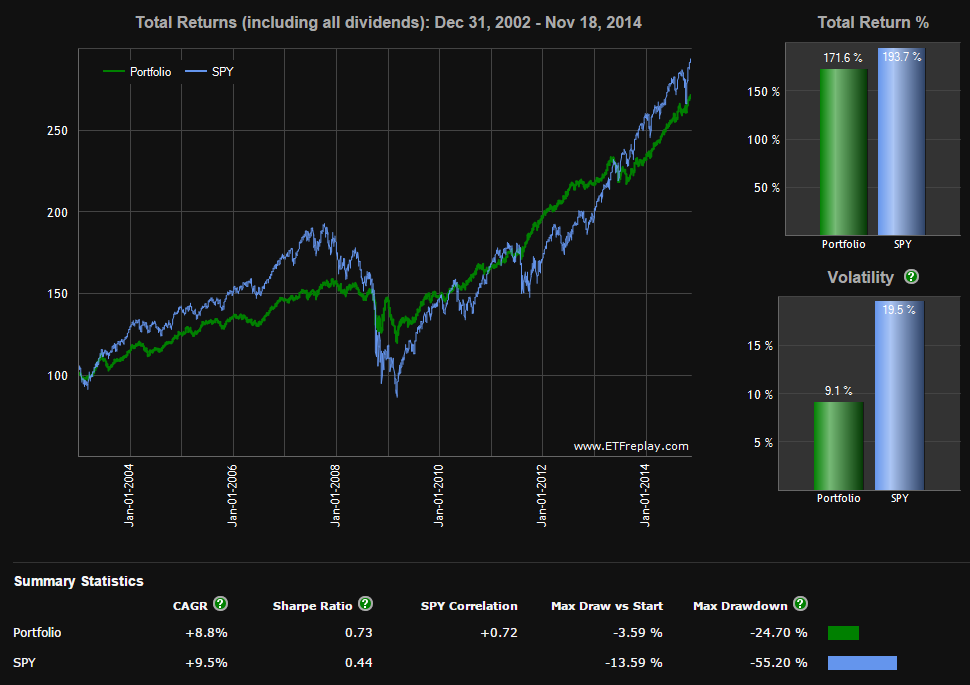

Another strategy would be to invest 50% of your money in SPY and 50% in TLT and do a monthly rebalancing. This gave you 8.8% return during the last 10 years.

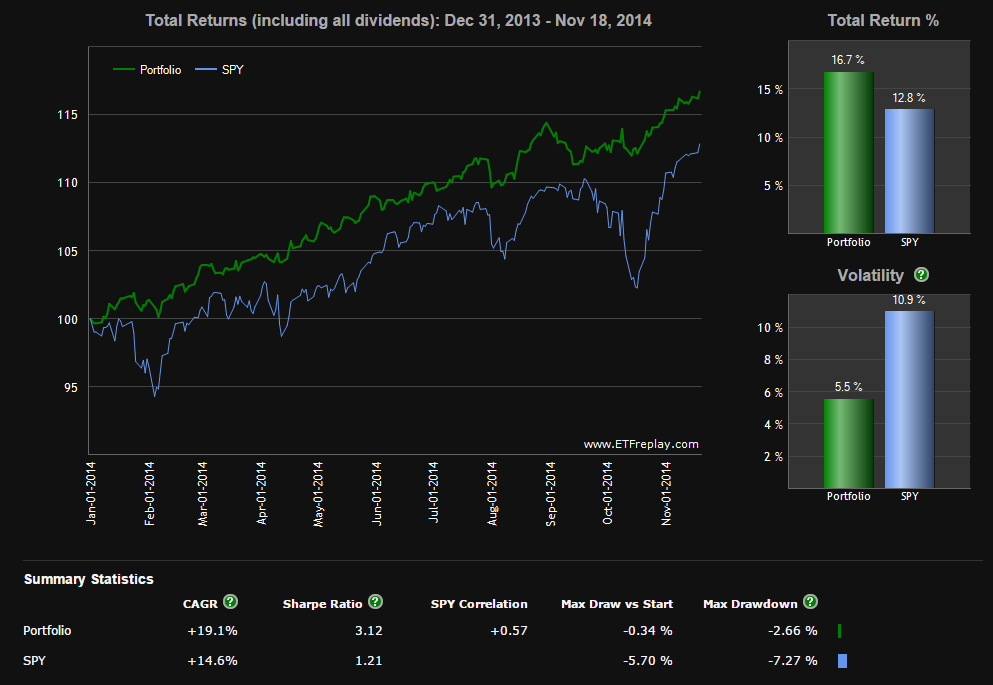

Now let's see, how these two strategies performed the first 10 month of 2014. For quite some time we now had a sort of a sideways market. Conflicts like Syria or Ukraine made investors switch several times in “risk off” mode which favors safe haven assets like our TLT Treasury, but shortly after they switched back to “risk on” mode favoring our SPY stock market ETF. Such whipsaw market is bad for rotation strategies and as a result our SPY-TLT switching strategy only made 5.6% during the first 10 months with a Sharpe ratio of 0.59.

This time the much better strategy was to hold equal positions of SPY and TLT. This strategy made 16.7% during the first 10 months with an very high Sharpe ratio of 3.12.

If you analyze these two strategies, then you will quickly see which are the advantages and disadvantages of each strategy. The switching strategy did well during market periods with a strong up or down trend. In 2008 this strategy could avoid the stock market crash by switching nearly 100% to Treasuries. During sideways market periods and especially during whipsaw market periods, the switching strategy switched a lot of times too late, which resulted in an unwanted sell low and buy high strategy.

The idea for this Universal Investment Strategy was to develop a strategy which has an adaptive allocation between 0% and 100% for each ETF depending of the market situation. I am using such a strategy for quite some time with excellent results. Since 2014 the strategy invests always approximately equal parts of TLT and SPY.

The way to calculate the optimum composition is done by calculating which composition had the maximum Sharpe ratio during an optimized look back period (normally 50-80 days). During normal market periods, the maximum Sharpe ratio is not at a 100% SPY or at a 100% TLT allocation, but somewhere in between. To calculate this maximum Sharpe ratio, I loop through all possible compositions from 0%SPY-100%TLT to 100%SPY-0%TLT and calculate the resulting Sharpe ratio for the look back period.