Although the financial press is all lathered up about the last minute trade agreement reached between the Americans and the Canadians, I am left asking, “what's the big deal, eh?”

Did we really expect anything different? Sure, Trump blustered about how much he didn't like the Canadian negotiating team and that we had been taking advantage of Americans for far too long. He assured his base that this would change under his leadership. But this is how Trump negotiates. He takes extreme stances. He insults his counterparties. He appears unrelenting and unwilling to compromise. And then, at the last minute, he makes the best deal he can. It's par for the course.

Does this work? Who knows? I certainly don't have a clue about its effectiveness and I don't really care. All I know is that the market seems awfully slow at figuring this game out.

But the real question on my mind is whether today's Canadian dollar strength is merely a sell-the-rumor-buy-the-news type event or the start of a larger move higher.

The CAD buying started late Friday afternoon, and has continued all day today.

Yet will this flame out in the coming days? Or will the break below 1.2925 support prove to be the technical breakdown Loonie bulls are looking for?

To answer that question, let's have a look at two of the most important factors in Canadian dollar price level determination.

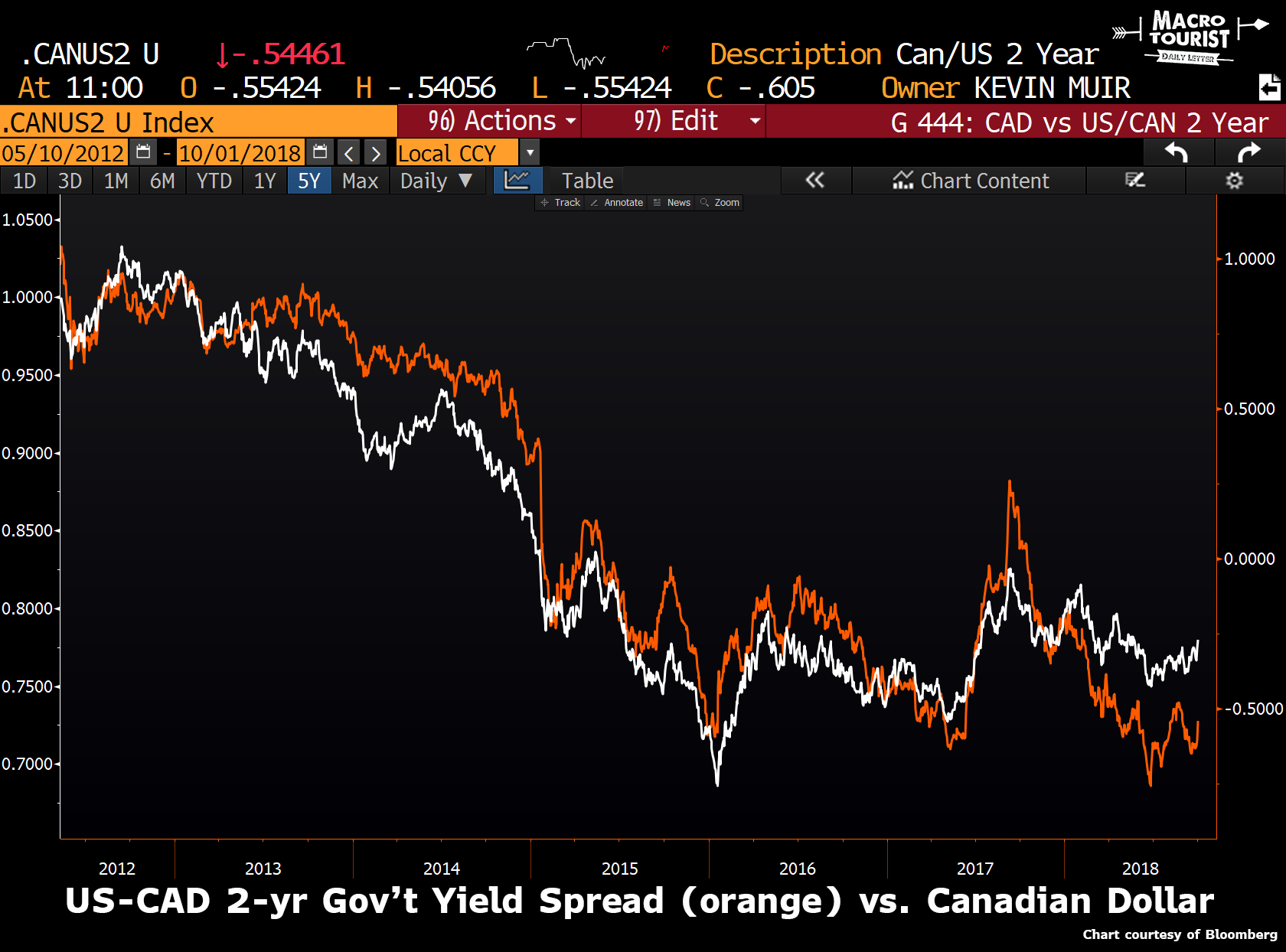

The first being the difference between US and Canadian interest rates. The part of the curve that seems to do the best job at tracking USDCAD movement is the two year, so here is a chart of the US-Canada 2-year government yield spread versus the Canadian dollar (priced in CADUSD terms):

Even with the NAFTA worries of the past six months, the Canadian dollar has outperformed the 2-year spread differential. According to this simple model, we should expect the Loonie to be almost a nickel lower given the yield spread.