Well it finally happened. Dow 20K, that is. And yes, there were hats – lots of hats.

Photo credit: WSJ.com

After struggling with the big, round number since the middle of December, the venerable Dow Jones Industrial Average finally broke above the 20,000 level and closed Wednesday at a new all-time high of 2068.51.

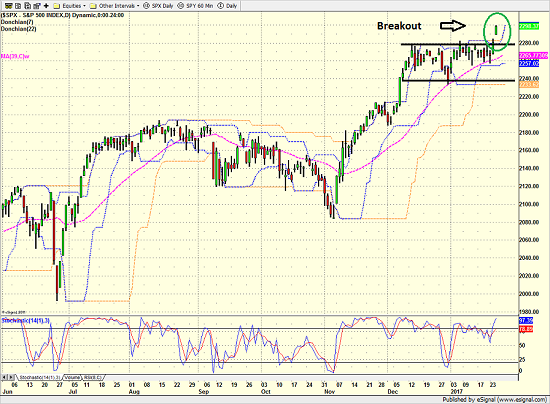

The S&P 500, NASDAQ Composite, and S&P 400 Mid cap indices confirmed the move as all the major indices save the Russell 2000 small caps, broke above their respective trading range ceilings into new high territory. And from a technical perspective, this is a good thing.

S&P 500 – Daily

View Larger Image

The question, of course, is why? Or, perhaps more appropriately, why now?

The answer appears to be simple. Actions speak louder than words. And the executive orders that President Trump has been busy signing this week have reminded traders that the Trump administration intends on making good on the promises made during the campaign. (What a concept.)

After rallying furiously from just before the election (November 7 to be exact) on the “idea of” and “hope for” better days ahead in terms of lower taxes, reduced regulation, and a better economy, the market then stalled in mid- December. Traders worried that the goals of the Trump administration might be too lofty to achieve. After all, Trump would still have to deal with the politics of Washington.

But with executive orders being signed daily designed to actually put plans in motion, the bottom line is traders are feeling better about the prospects for greener pastures.

The latest excitement in the market centered around “the wall” to be erected between the border of the U.S. and Mexico. And as you may recall, Mexico is supposed to pay for it.

This created a rally in U.S. construction and engineering firms. Ironically, the massive Mexican cement company, Cemex (NYSE: CX), has also benefited from all the talk about building the wall as shares have rallied 21.5% in the last 8 days.