US Treasury note yielded 3.09% which open doors for more aggressive Fed tightening, Long USD/JPY?

After months of dollar sell-off since the start of 2018, the dollar has reach its strongest point since December.

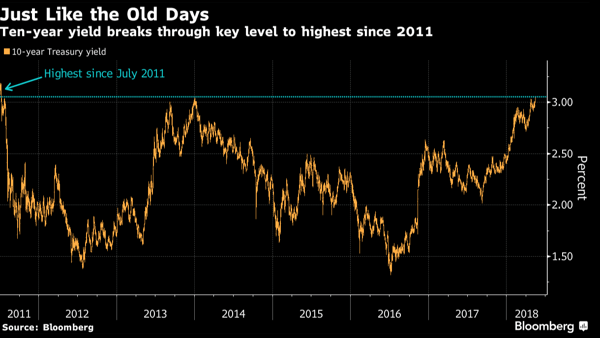

Chart below shows the 10-year yield breaking back to 2011 levels.

The implication of 10-year yield breaking 3% is that inflation now has more upside potential.

retail sales yesterday also showed a moderate rise last month in April. This means that consumer spending is now on track after a slowdown in the first quarter.

According to Bloomberg, traders are now expecting a 2.5 additional quarter-point hikes in 2018, which is more than the “dot plot” from the central bank.

The greenback broke its psychological barrier of 110 versus the yen after 3 months of sell-off. We are seeing more upside to come for USD/JPY as the US 10-year yield is onward to 3.2% with no resistance in sight.