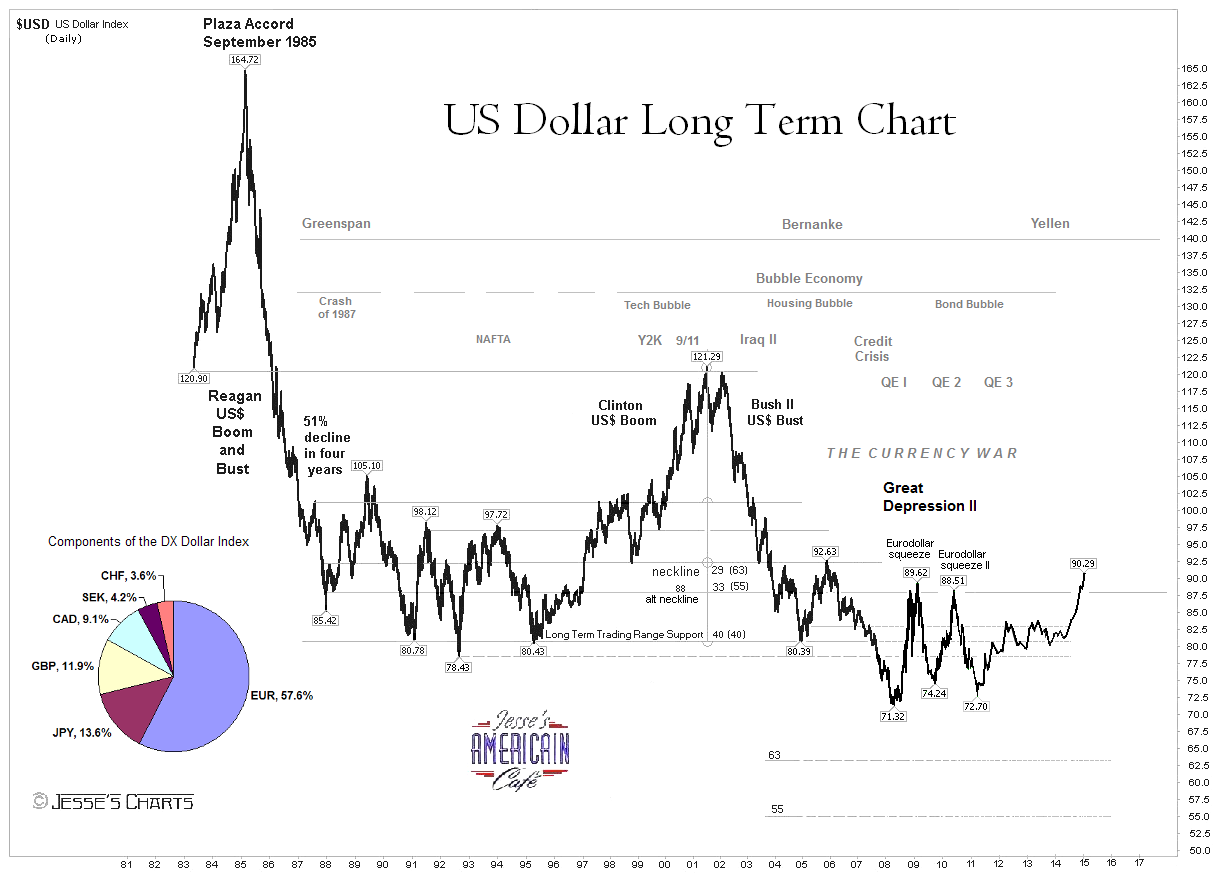

The US dollar has ended this year on a high note not seen in some time, not since the time of the financial crisis and collapse in 2008.

Dollar strength, at least in this index, is largely a reciprocal function of weakness in the euro, and to a lesser extent the yen, the pound, and the loon.

I have not worked the data yet, and may not do so for some time, but I would imagine that this spike in dollar strength will see the same sort of demand coming out of Europe as we saw in the two prior instances labeled Eurodollar Squeeze I & II.

This time it is most likely helped by the ongoing crisis in the yen and the ruble, the first being the objective of Abenomics, and the latter being the target of the West, through the actions of their sanctions and the currency action of their banks, in this phase of the ongoing currency war.

In general, a stronger currency helps the financial and foreign investment sectors of a nation, and is much less helpful for the manufacturing and producing sectors. It tends to make exports more expensive, and imports more affordable. And it gives purchasing power for those of a mind to acquire and privatize major foreign assets.

This is not a prescription for a recovery in a real producing economy, but it is a boost to the moneyed class of financiers.

Let's see how things develop in 2015.