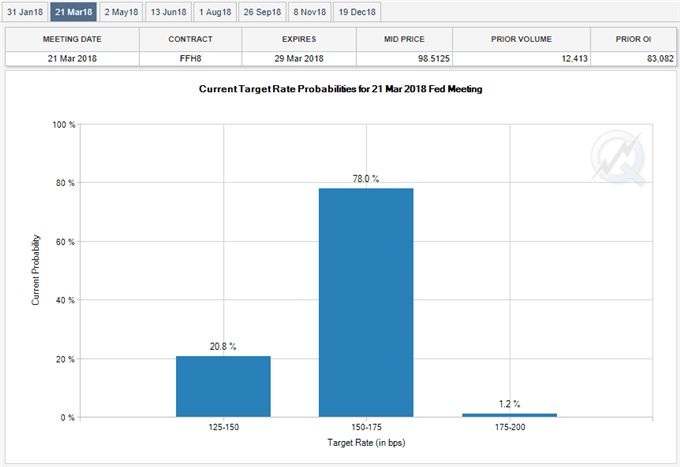

USD/JPY snaps the recent string of lower lows, with the dollar-yen exchange rate at risks of staging a larger recovery should federal reserve officials boost expectations for a March rate-hike.

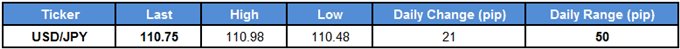

While the Federal Open Market Committee (FOMC) is widely anticipated to retain the current policy at the next interest rate decision on January 31, Fed Fund Futures now highlight a greater than 70% chance for a move in March as the central bank forecasts three rate-hikes for this year. In turn, market participants may pay increased attention to Cleveland Fed President Loretta Mester as the 2018 voting-member is set to speak over the coming days, and growing bets for higher borrowing-costs may fuel the recent rebound in USD/JPY especially as the Bank of Japan (BoJ) continues to embark on its Quantitative/Qualitative Easing (QQE) Program with Yield-Curve Control.

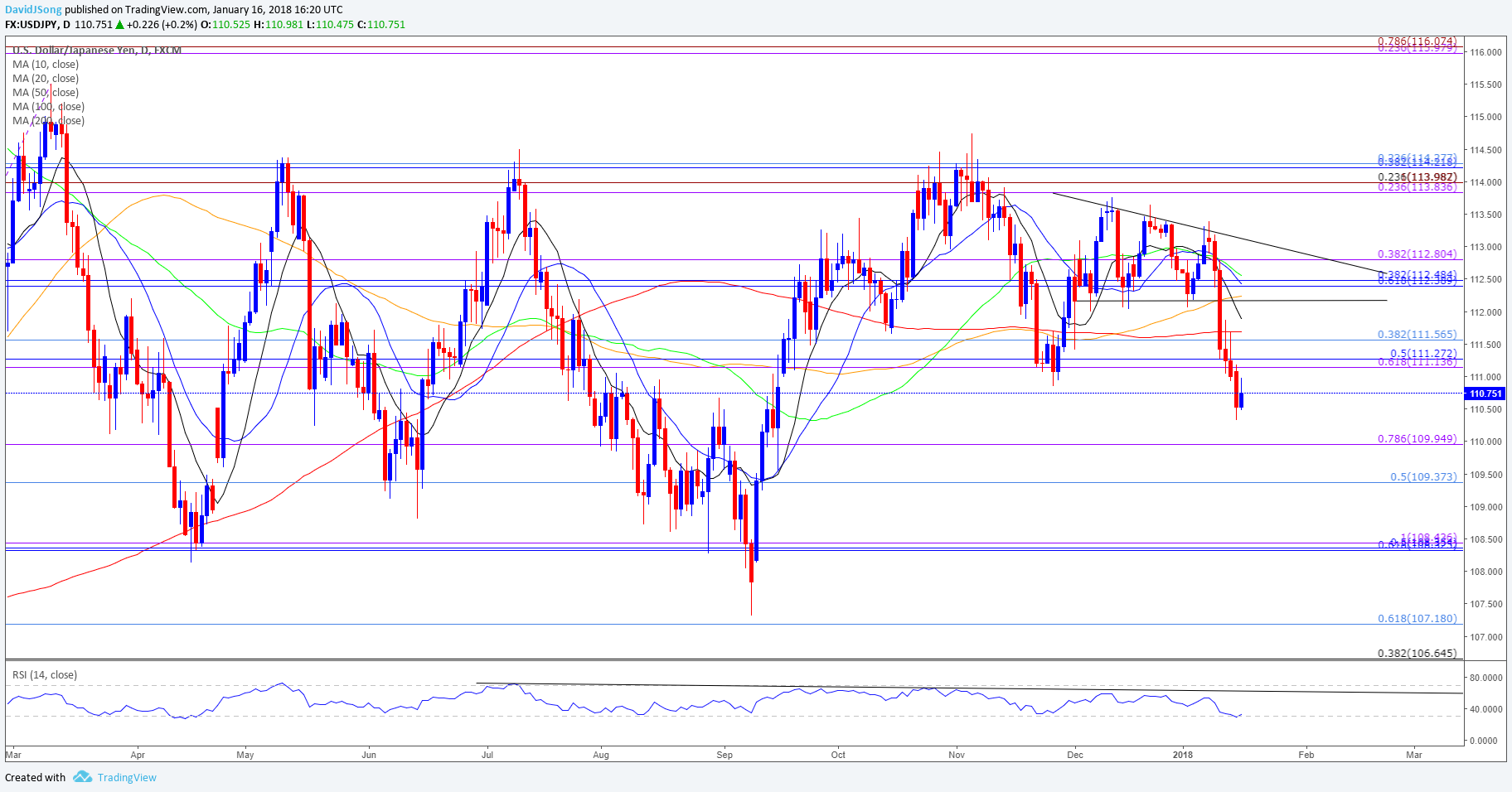

Nevertheless, the break of the descending triangle keeps the broader outlook tilted to the downside especially as USD/JPY clears the November-low (110.84), but the near-term decline in the dollar-yen exchange rate appears to have run its course as the Relative Strength Index (RSI) fails to push into oversold territory.

USD/JPY Daily Chart

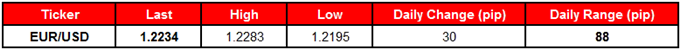

Fresh updates to the Euro-Zone Consumer Price Index (CPI) may do little to derail the near-term advance in EUR/USD as the European Central Bank (ECB) shows a greater willingness to end its quantitative easing (QE) program in 2018.