After clinging to the green all day, despite a strong dollar, WTI/RBOB slipped into the red after API reported a much bigger than expected (and surprise) crude build (+4.854mm vs -1.75mm exp).

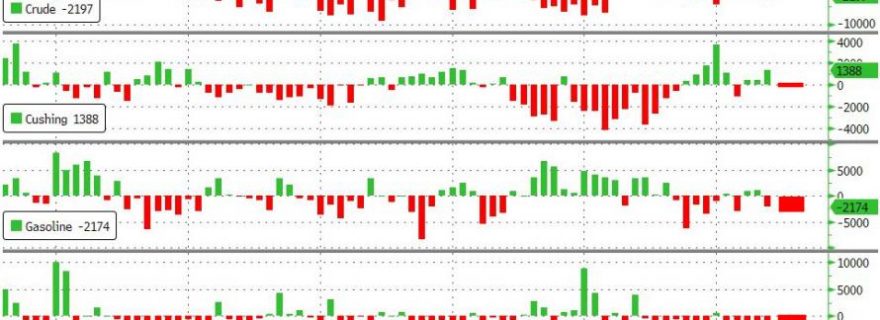

API

Crude +4.845mm (-1.75mm exp)

Cushing +62k (+550k exp)

Gasoline -3.369mm

Distillates -768k

After drawing down last week, expectations were for crude draw this week but API reported a large surprise crude build…

Crude inventories are 2.4% below the five-year norm, while Cushing stockpiles are about 30.5% below the average.

WTI/RBOB managed gains today (RBOB highest since Oct 2014)- despite the dollar strength – heading into API…but kneejerked notably lower on the print…

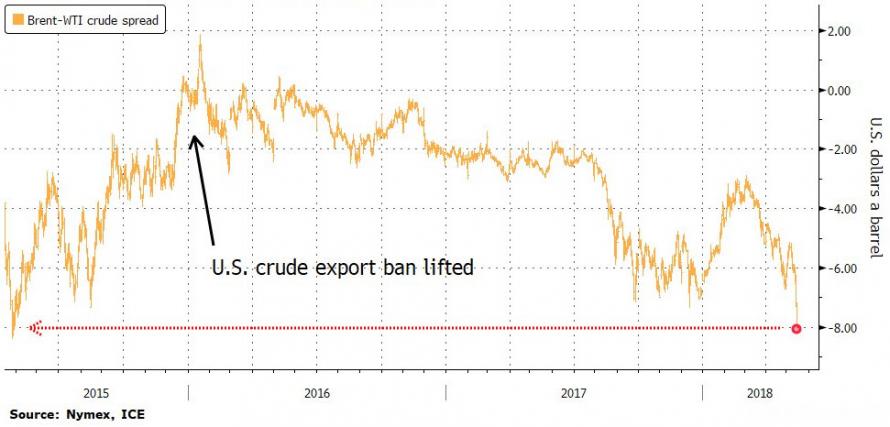

As Bloomberg reports, a large number of drilled-but-uncompleted wells in shale plays and the potential for rising output have weighed on American prices, said Walter Zimmermann, chief technical analyst at ICAP-TA.

“You are probably seeing some serious producer hedging into these lofty levels here, whereas I don't see anybody keen to hedge against Brent given these geopolitical fears.”

Notably, the Brent-WTI spread blew out to $8 today…